Did you get shaken out of the great stock you owned? Shakeouts happen. What to do with them? If you’ve ever felt the rug pulled from under your feet by the stock market’s sudden jolt, you’re not alone. This little journey of ours will navigate through the stormy seas of shakeouts and guide you on what to do when the market decides to play dirty. And believe me, it does play dirty, but who says we can’t get a little crafty ourselves?

Understanding Shakeouts

The Importance of Reassessment

So, you’ve been shaken out. What now? Cry over spilled milk? I think not. The real play here is to reassess the situation. Let me share a little secret with you: a quick glance at some key metrics usually suffices. Why, you ask? Because you’ve done most of the heavy lifting before. In the sections that follow, I’ll show you how to make this reassessment your secret weapon, turning a potential setback into a strategic pivot.

Unpacking the Reassessment Toolbox

First things first, let’s delve into the tools at your disposal. Remember, the key to a successful reassessment lies in the details you’ve already uncovered. These are the metrics and analyses you’ve meticulously put together during your initial assessment. And here’s the twist: they haven’t lost their value. In fact, they’re about to prove their worth all over again.

Revisiting Key Metrics

At this juncture, revisiting key metrics is not just advisable; it’s essential. Look back at the earnings growth, debt levels, and revenue trends. And here’s the clincher: pay special attention to any recent changes that might have triggered the shakeout. Could it be a temporary blip or a fundamental shift? This distinction will guide your next move.

The CAN SLIM Refresher

Moreover, it’s the perfect time for a CAN SLIM strategy refresher. This methodology isn’t just a one-time checklist; it’s a dynamic framework for ongoing decision-making. Ask yourself: Does the stock still exhibit the CAN SLIM qualities? Is the ‘C’ or current earnings, still strong? Is there a new ‘N’, such as a product launch or management change, that could reignite interest? This isn’t just reassessment; it’s strategic recalibration.

Market Sentiment and Technical Analysis

Additionally, consider the broader market sentiment and technical indicators. Sometimes, the market’s mood swings can be more volatile than the fundamentals warrant. And remember, technical analysis can provide crucial insights into investor behavior and potential turning points. So, arm yourself with this knowledge, and prepare to make informed decisions.

Making Reassessment Your Secret Weapon

Finally, here’s how you turn reassessment into your secret weapon: by being proactive, not reactive. Use this opportunity not just to look back but to strategize forward. With all the information at hand, ask yourself: Is the stock undervalued? Is the market overreacting? This is where your prior analysis, combined with fresh insights, becomes your roadmap.

So, what’s the takeaway? Reassessment isn’t about dwelling on the past; it’s about leveraging your initial groundwork to navigate future uncertainties. And remember, the stock market is as much about psychology as it is about economics. By keeping a cool head and revisiting your analysis, you’re not just reacting to market movements; you’re anticipating them. This, my friends, is how you play the game to win.

Recognizing the Buying Signal

And here’s where it gets interesting. Identifying the moment your stock is ripe for the picking again can feel like finding a needle in a haystack. But fear not, I’ll guide you through spotting those golden signals that scream, “Buy me back, will you?” And no, it’s not just about gut feeling. Let’s unpack the art of recognizing the buying signal, turning the seemingly impossible task into a mastered skill.

The Art of Timing

First and foremost, timing is everything in the stock market. Catching the right moment to re-enter a stock after a shakeout requires a keen eye and a bit of strategy. It’s about reading the market’s signs and signals, not relying on wishful thinking or random guesses. This timing doesn’t come from hunches; it’s derived from a careful analysis of market trends and stock performance.

Technical Analysis: Your Best Friend

Technical analysis becomes your best friend in identifying buying signals. Look for patterns that indicate a stock has bottomed out and is starting to rebound. Key indicators include a stock stabilizing above its moving averages, bullish candlestick patterns, and increasing trading volume. These signs suggest that the stock is regaining strength and that investor sentiment is turning positive.

The Role of Fundamental Analysis

In addition to technical indicators, fundamental analysis should not be overlooked. A return to strong fundamentals, such as improving earnings reports, positive industry news, or other value indicators, can signal a buying opportunity. It’s the combination of improving fundamentals and positive technical signals that often heralds a stock’s readiness for a rebound.

Market Sentiment and News

Paying attention to market sentiment and news is also critical. Sometimes, a stock is undervalued due to overreaction to negative news or market volatility. When the dust settles, and it becomes clear that the company’s fundamentals remain strong, it might be the perfect time to buy back in. Always keep an ear to the ground for news that could affect the stock’s value and investor perception.

Trusting Your Research

Finally, trusting the research you’ve conducted is paramount. You’ve already done the hard work of analyzing the stock before the shakeout. If your initial assessment was positive and the reasons for your investment haven’t fundamentally changed, then the stock’s drop might present a discounted buying opportunity. Trust in your analysis and be ready to make a move when the signals align.

summary

Recognizing the buying signal after a shakeout isn’t about luck; it’s about leveraging a mix of technical analysis, fundamental insights, and market sentiment. It’s a skill that, with practice, can significantly enhance your investment strategy, allowing you to capitalize on opportunities others might miss. Remember, the best investors aren’t just those who can predict the future; they’re those who can read the present with clarity and act accordingly.

Case Studies: Shakeouts That Shook Up the Market

Curious about how others have navigated through these treacherous waters? I’ve got you covered with some nail-biting case studies of shakeouts that made and broke fortunes. By the end, you’ll be itching to tackle your next shakeout head-on.

details at a glance

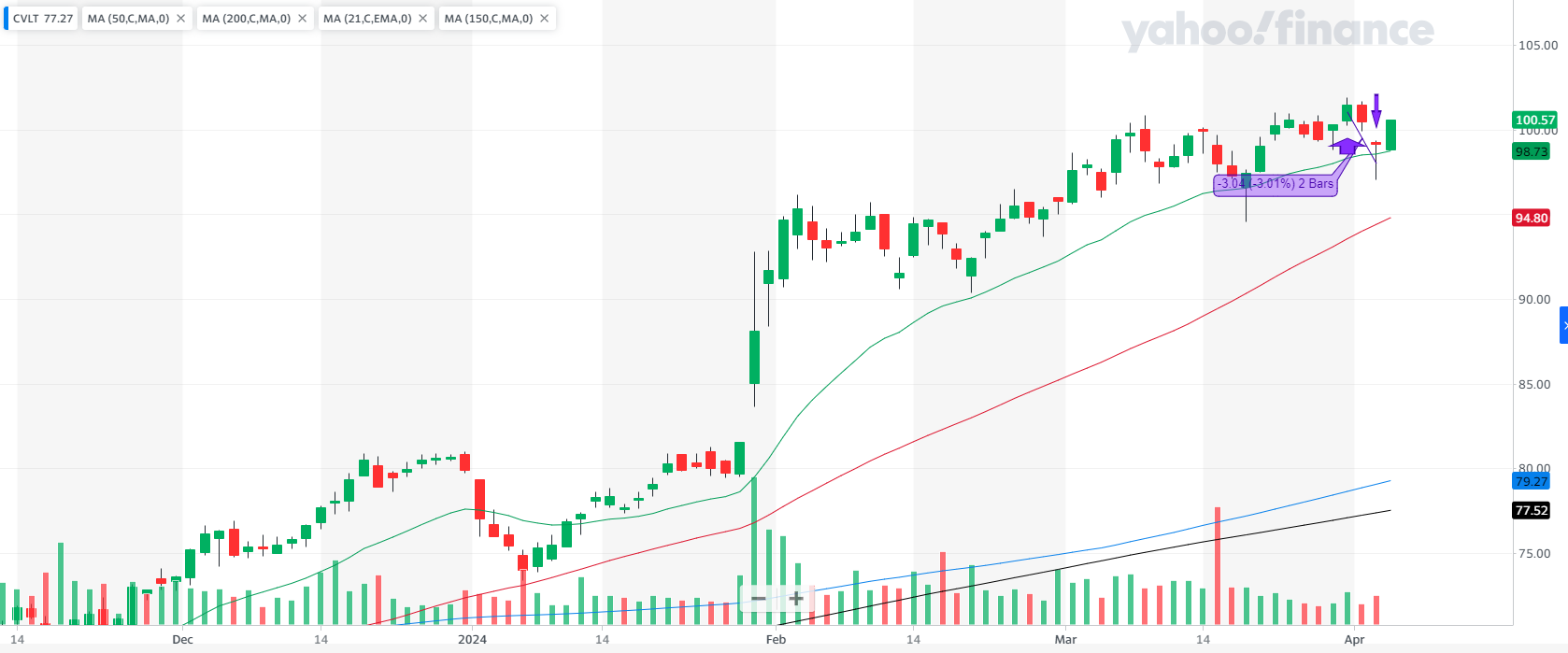

- The upward purple arrow shows where I bought the stock. The downward purple arrow shows where I sold it.

- Green Line 21-day exponential moving average line (see EMA 21 below)

- Red Line 50-day simple moving average line (see SMA 50 below)

- Black LIne 200-day simple moving average line (see SMA 200 below)

Opening

- Underlying: CVLT

- Date of trade initiation: 28 Mar 2024

- Underlying price at trade initiation: $101.76

- Stop loss set at $98.77

- Profit target: $122.11

- Market outlook at trade initiation: Confirmed uptrend

- RS (Relative Strength) Rating: 92

- RS line trend: Neutral (N)

- Industry Rank: 1 out of 197

- Volume Up/Down Ratio: 2.2

- Institutional Ownership Trend: Upward (U)

- Position risk as a percentage: 2.91%

- Position Risk to Next Level (NL) as a percentage: 0.13%

- Potential profit for the position as a percentage: 19.81%

- Risk to Reward Ratio: 0.15

- Position size as a percentage of portfolio: 4.54%

opening summary

- Reason for trade initiation: “I bought back the previously owned stock because its price broke above $100. The stock is accumulated by the market quite heavily and also by the institutions. The price of the stock bounced up from the 21-day exponential moving average which acts as a support level to the stock price.”

- Evaluation of buy as ideal: No. The price was not in the buy zone and the volume was insufficient.

- Additional remarks: “I placed a stop-loss below $100 level and below 21 exponential moving average line. One concern is that RS-line trend is neutral. It would be better if it was in uptrend.”

Closing

- Date of trade closure: 2 Apr 2024

- Closing price: $98.99

- Market outlook at trade closure: Confirmed uptrend

- RS Rating at closure: 92

- Change in RS rating: 0

- Remarks at trade closure: “Stopped out on a market down day. Price action triggered my stop-loss and shook me out and bounced back up above EMA 21.”

Results

- What went well: “I picked a stock with high – 2.2 Up/Down volume ratio. The latest base was low which indicated a strong price action.”

- Cause of Error / IMPROVE: “I should have traded the stock already at 80-s level. Then it broke out of the base.”

- Position ROI, %: -4.63%

- Position ROI (portfolio), %: -0.21%

- Position Open Time (trading days): 2

- Position Open Time (days): 5

terms and definitions

A glossary of terms and definitions used throughout the article, designed to help readers better understand the concepts discussed.

- Shakeout: A rapid drop in a stock’s price designed to scare off investors.

- Reassessment: The act of re-evaluating a stock’s potential after a shakeout.

- Buying Signal: Indicators that a stock is potentially undervalued and ripe for purchase.

- EMA 21 Calculates the 21-period exponential moving average, highlighting short-term trends.

- SMA 50 Averages the price over 50 periods, showing medium-term trends without overemphasizing recent data.

- SMA 200 Averages the price over 200 periods, revealing long-term trends by treating all data equally.

- Industry Rank Investor’s Business Daily’s system that ranks industries 1 to 197 based on performance. It guides us in CAN SLIM TRADING towards leading sectors.

- U/D Ratio Measures stocks closing up versus down. A ratio above 1.0 indicates bullish sentiment, important in CAN SLIM TRADING.

- RS Rating Ranks a stock’s performance on a 1 to 99 scale. I look for at least 85, showing strong momentum and growth potential.

- RS Line Compares stock price to the market, plotted as a ratio. We seek an uptrend, indicating outperformance and strong momentum.

- Volatility Measures how much a security’s price fluctuates over time. High volatility means large price changes, indicating risk and potential reward.

- Institutional Ownership Trend indicates whether the stock is under accumulation or distribution by the institutions.

- EPS (Earnings Per Share): A financial metric calculated by dividing a company’s net profit by the number of its outstanding shares. It indicates the amount of profit attributed to each share of stock, serving as a key indicator of a company’s profitability.

can slim explanation

The CAN SLIM strategy is a sophisticated investment methodology developed by William J. O’Neil, aimed at guiding investors toward identifying high-growth stocks before they make substantial price advances. Each letter in “CAN SLIM” encapsulates a critical element of this strategy, providing a structured approach to stock selection.

- C for Current Earnings: Initially, focus on companies exhibiting a robust record of quarterly earnings growth. Specifically, these should be firms showing a significant percentage increase in earnings per share (EPS) in the most recent quarter compared to the same quarter the previous year.

- A for Annual Earnings Growth: Subsequently, direct attention to companies that have demonstrated solid annual earnings growth over the last five years. This emphasizes the importance of sustained profitability, highlighting companies with a consistent ability to increase earnings.

- N for New Products, New Management, or New Highs: Moreover, it’s advantageous to invest in companies benefiting from new products, new management, or reaching new market highs. This principle rests on the notion that stocks often achieve new price heights due to fresh conditions that boost their growth and investment appeal.

- S for Supply and Demand: The dynamic of supply and demand also plays a pivotal role. A limited supply of shares, coupled with substantial volume demand, can propel stock prices upward. This aspect of the strategy stresses the importance of buying stocks with strong demand yet a constrained supply.

- L for Leader or Laggard: Furthermore, the strategy advises investing in market leaders as opposed to laggards within the same industry. Identifying market leaders is crucial, as these are stocks characterized by their superior price performance and market share.

- I for Institutional Sponsorship: Additionally, seek out stocks that enjoy the backing of institutional investors, such as mutual funds, pension funds, and hedge funds. The underlying idea is that support from significant financial players can catalyze a stock’s upward trajectory.

- M for Market Direction: Lastly, gaining an understanding of the overall market trend is essential. This can be achieved by analyzing major indexes like the S&P 500 or the Nasdaq Composite. The strategy advocates for investing during a confirmed market uptrend and suggests caution, potentially selling stocks, when the market appears to be on a downward trend.

Conclusion: Mastery Over Market Mayhem

Learning from the Market’s Lessons

Remember that heart-sinking moment when the market seemed to conspire against you? Ironically, that was the market offering you a valuable lesson, albeit in a tough-love manner. Such trades, as daunting as they are, serve as critical learning moments. Interestingly, it’s often the small details, such as those seemingly negligible $1 commissions, that unveil the deeper intricacies of trading. These minor aspects cumulatively impact our trading outcomes more significantly than we might initially realize.

Unveiling the Real Costs

Moreover, who would have guessed? The aggregate toll of a shakeout, especially when you factor in commissions, frequently exceeds the anticipated loss, sometimes by more than just a nominal $4. Consequently, these episodes shine a spotlight on the complex nature of trading expenses, reminding us that the essence of trading transcends mere numbers.

Rising Above Challenges

Therefore, faced with the aftermath of a shakeout, what should one’s strategy be? It certainly isn’t to dwell in despair. Instead, the optimal approach is to meet adversity with optimism, reassess with enhanced insight, and reengage with the market more prepared than before. Importantly, our voyage through the stock market is not merely about tallying wins and losses; rather, it’s about the continuous process of learning, adapting, and fortifying our resolve.

Stepping Back Into the Arena

Thus, isn’t this relentless pursuit of growth and improvement what enriches our journey, not just in the market but in life itself? Armed with these invaluable lessons, are you poised to confront the market with renewed vigor? I firmly believe you are. Let us confidently reenter the fray, armed with our newfound knowledge and insights, ready to display our resilience and strategic acumen. It’s time to prove that we are not merely surviving in the market but thriving, mastering our financial destinies with grace and determination.