11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist |

READ THIS BLOG POST and in less than 15 minutes you have a LIST OF 6 TOP-NOTCH market leaders to buy right now PLUS 5 high-quality stocks reaching their buying points.

Also, I’m giving an up-to-date list of stocks in my portfolio with comments. So you can compare it with your preferences.

There are still plenty of things to buy right now. More than one person can handle. Down below are the best of the best actionable stocks to consider RIGHT NOW.

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

MARKET OVERVIEW

nasdaq

The NASDAQ is currently experiencing a steady uptrend, with its price at the upper part of its channel. This positioning suggests that we might see a slight decline or an extension in prices as the market navigates its upper limits.

Notably, tech giants, often referred to as the “masters of the market,” are spearheading this ascent, making the NASDAQ a significant index to watch.

Here’s the NASDAQ chart (to see the image better just drag and drop the picture to the folder in your computer):

Also, see how the overall market is doing…

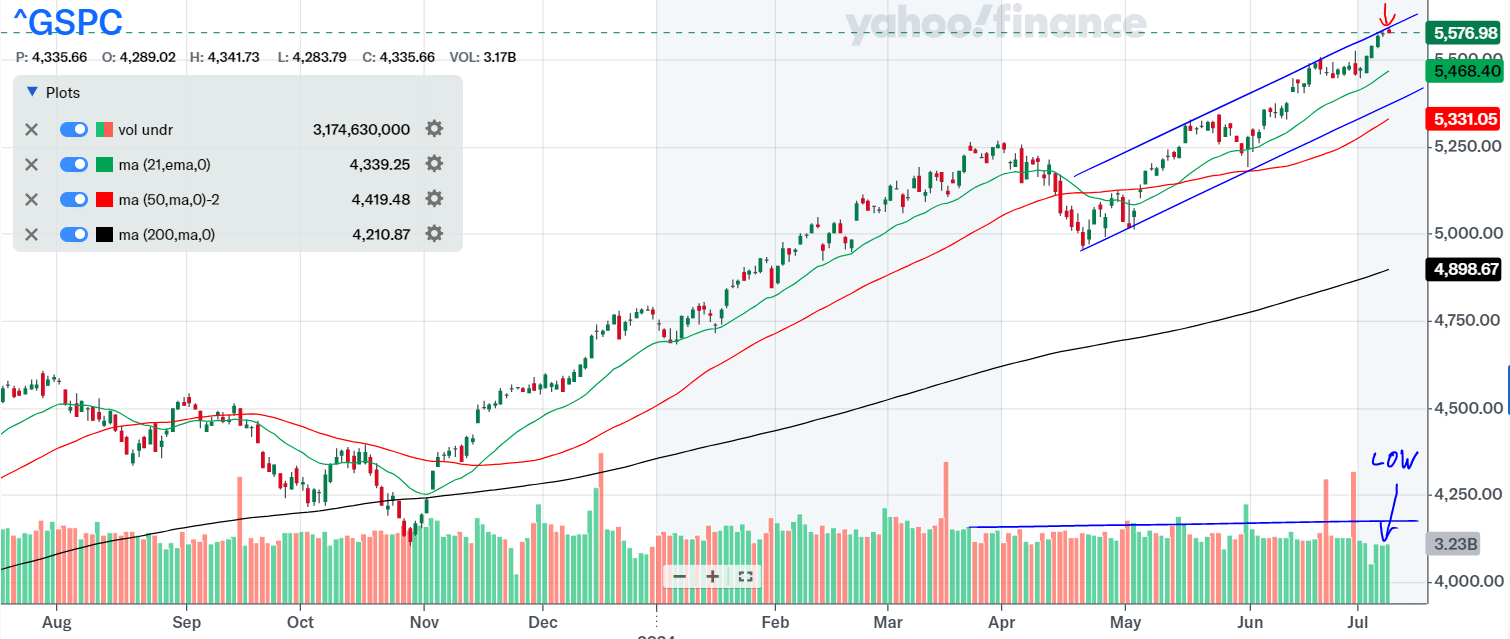

s&P 500

In comparison, the S&P 500 is performing robustly, securing its spot as the second-best market. The probable reason for its standout performance is the strong showing of technology stocks, which are outpacing other sectors.

The S&P 500 exhibits a calmer demeanor than the NASDAQ and does not appear to be overextended at this moment. Its current state suggests a healthy market environment, conducive to initiating new positions.

However, it’s worth noting that overall market volume is relatively low, likely due to the seasonal summer slowdown. This dip in activity could introduce additional volatility, as smaller, often more reactive investors become a more dominant force in the market.

Here’s the S&P500 chart (to see the image better just drag and drop the picture to the folder in your computer):

If you want to visit an interactive chart, click here.

Overall, since these two indexes are in a clear uptrend and not too extended, it seems to be a good time for taking positions. That being said, we always need to be cautious and ready to make adjustments in our decisions.

Finally, see how the industrials are doing.

Dow Jones Industrial Average

Meanwhile, the Dow Jones Industrial Average is not lagging significantly but does find itself trailing behind the S&P 500. Despite this, the Dow Jones remains in an uptrend and is maintaining a position above its key moving averages.

This is a positive sign that supports the broader market’s upward trajectory. Such alignment among major indexes reinforces the notion that the overall market is on a solid upward path.

Here’s the DJIA chart (to see the image better just drag and drop the picture to the folder in your computer):

At this point, it’s best to move on with individual stocks. Read on.

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

#1 Abercrombie & Fitch (ANF)

The stock stands out as a market leader, outperforming 99% of its peers and meeting the CAN SLIM criteria, which marks it as a favorable buy. Both the market and institutional investors are actively accumulating it. However, the stock price is currently outside the buy zone, and its industry rank of 24 out of 197, while respectable, could improve if it reached the TOP 10.

Despite these issues, taking a position might be a good idea. The stock price is holding at the EMA 21 line, which has historically served as a support line. Additionally, the decreasing volatility in the price chart suggests growth potential.

- Stock: ANF

- Company Name: Abercrombie & Fitch

- Next EPS Date: 22 Aug

- Industry Rank 24/197

- Up/Down Ratio: 1.6

- EPS Trend: Up

- RS Rating: 99

- RS Trend: Up

- Institutional Ownership Trend: Up

- Maximum Position Size of a Portfolio, %: 5

- Maximum Favorable Buying Price: $183.00

- Stop-Loss: $173.85

- Profit Target: $210.45

- Position Risk, %: 5.00

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

#2 vital Farms (VITL)

This stock, similar to ANF, leads the market by outperforming 99% of stocks and aligns with the CAN SLIM criteria. Market and institutional accumulation is evident.

However, it is not currently in the buy zone, sitting about 5% above the EMA 21 line; less than 3% would be ideal. The intraday volatility is high, and its industry rank at 21 out of 197 could improve if it were in the TOP 10.

The proximity of the upcoming earnings date might also hinder building a 5% profit cushion. Before earnings, we should get out of the positions that haven’t built that cushion.

Taking a small position with a stop-loss set below the EMA 21 line makes sense as a low-risk position.

- Stock: VITL

- Company Name: Vital Farms

- Next EPS Date: 1 Aug

- Industry Rank: 21/197

- Up/Down Ratio: 1.1

- EPS Trend: Up

- RS Rating: 99

- RS Trend: Up

- Institutional Ownership Trend: Up

- Maximum Position Size of a Portfolio, %: 5

- Maximum Favorable Buying Price: $46.01

- Stop-Loss: $43.02

- Profit Target: $54.98

- Position Risk, %: 6.50

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

#3 TransMedics Group (TMDX)

- Stock: TMDX

- Company Name: TransMedics Group

- Next EPS Date: 1 August

- Industry Rank 80/197

- Up/Down Ratio: 2

- EPS Trend: Up

- RS Rating: 98

- RS Trend: Up

- Institutional Ownership Trend: Up

- Maximum Position Size of a Portfolio, %: 5

- Maximum Favorable Buying Price: $151.96

- Stop-Loss: $144.36

- Profit Target: $174.75

- Position Risk, %: 5.00

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

3 can slim stocks #in the buy zone

ELF

- Maximum Favorable Buying Price: $ 212.16

NVO

- Maximum Favorable Buying Price: $ 143.78

PINS

- Maximum Favorable Buying Price: $ 43.51

These are the ones that have just broken out of the base and are in the buy zone. This makes them less risky.

5 more market leaders

Here are some more strong stocks that also fit the CAN SLIM criteria and are actionable. These are just not the best of the best but very good. The sequence starts with the best performer:

| Ticker | Company Name | RS Rating |

| AEM | Agnico-Eagle Miners | 93 |

| CYBR | CyberArk Software | 93 |

| GRMN | Garmin | 92 |

| HLNE | Hamilton Lane CI A | 91 |

| APO | Apollo Global Management | 88 |

Most of these stocks are building the base and their prices are slightly below the buy zone. So, it’s a good idea to keep an eye on them. Let’s change gears and move on with my open positions.

Eventually, let’s see how I have positioned myself in the market and what are the main changes from the last time.

victor’s holdings

Here’s my stock portfolio as of this writing. The sequence starts with the biggest position:

| Ticker | Company Name | % Of The Portfolio | Comments |

| AMZN | Amazon | 17.74 | |

| GOOGL | Alphabet CI A | 16.84 | I bought it because the stock bonced up from the EMA 21 line. Also, the stock is under heavy accumulation by the overall market and by the institutions. |

| NVDA | NVIDIA | 11.75 | |

| NTAP | NetApp | 11.74 | |

| AAPL | Apple | 10.19 | I bought it because the stock was under heavy accumulation by the market. |

| JPM | JPMorgan Chase | 9.24 | I bought it because the stock broke out of its base. |

| MMYT | MakeMyTrip | 8.09 | I bought it because the stock broke out of its base with a strong volume. |

| RCL | Royal Caribbean Group | 7.26 | |

| ALKT | Alkami Technology | 6.76 | |

| ATGE | Adtalem Global Education | 5.96 | |

| NU | Nu Holdings A | 5.84 | |

| PINS | 5.79 | ||

| CLS | Celestica | 5.27 | I bought it because the stock bonced up from the EMA 21 line. |

portfolio changes compared to the last time

Sold out: CVLT, GSL, TXRH, HIG

Bought: AAPL, GOOGL, JPM, MMYT, CLS

As you can see – 4 sold, 5 bought.

I have used CAN SLIM trading and investing strategy for 2.5 years now. This is the first or second time my account is sitting on a margin, meaning I am also using the market’s money. Why?

Because there have been several buying opportunities and I haven’t gotten stopped out of my existing positions as easily as in 2022 for example. At that time, since the market was volatile, it was tough to capture a profit.

Thanks to sticking to the plan even at volatile times, my losses in 2022 were minimal.

a word about position sizing

As a default, my goal is to have about 10% of each stock in my portfolio. Usually, I start with a smaller size (5% for example) and once the price proves itself, I’m raising the position to 10%.

But there are some exceptions – if the stock is a very good performer or fairly safe stock with a good setup, I might increase the position to up to 25% of my portfolio. But this means that it has at least two stop-losses by that time.

conclusion

As you can see, there are still plenty of candidates in the market right now. All of them are good. We will never know exactly which ones will do better in the future and which ones will not.

This is the reason we must always use stop-losses.

And honor them.

Use this knowledge as a part of your research and you’ll have a great potential to beat the market.

P.S.

Trading stocks and managing positions daily while checking account growth is sometimes like watching the paint try – it may take a long time before you can move the needle.

For me, the account worth has stayed quite the same for several months. Am I doing something wrong? Maybe. Trading and writing these articles is my way of detecting the mistakes and correcting them.

But, I don’t think that I am making many fatal mistakes. Why?

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

Because I haven’t blown up my account! If I did, I would be bankrupt or at least, suffer severe losses.

In the beginning, I think being able to survive in every day stock market actions is okay. And part of the learning process.

What I have learned is that we need to stick to one strategy and master it before we move to the next one.

P.P.S.

If you have any thoughts or questions about trading or investing, fill out the form here and I’ll get back to you.

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

ADDITIONAL INFORMATION

stock REQUIREMENTS

Choosing the right stocks isn’t a game of chance; it’s a deliberate strategy. This time, with a plethora of options at my fingertips, I could afford to be pickier. So, what were the non-negotiables?

First off, industry leadership was paramount. I zeroed in on stocks from the top echelons—specifically, the TOP 10 out of 197 industries. Why? Because these represent the crème de la crème, the TOP 5% leading the charge. It’s not just about being good; it’s about being outstanding.

Next, the foundation matters. I looked for stocks with base depths signaling strength without overextension—ideally, between 10-20%, stretching up to 35% for those in a cup pattern. It’s a balance between stability and potential, ensuring our picks have solid ground beneath them.

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

Moreover, the up/down ratio needed to be above 1.0, a clear indicator of upward momentum. Similarly, the trend in institutional ownership couldn’t just be stable; it had to be climbing. These are the signs that savvy investors are not just watching but actively betting on these stocks.

The RS line and rating were the final seals of approval. An uptrend in the RS line and a rating of at least 85 out of 100 ensures we’re backing winners, not just participants.

By setting these stringent criteria, we’re not casting a wide net; we’re spearfishing for the best. In a sea of choices, we’re not looking for just any fish; we’re after the prize catches that promise not just to survive but to thrive.

TERMS AND DEFINITIONS

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

Ever felt like trading lingo was designed just to keep amateurs out of the loop? Let’s simplify a couple of terms:

EMA 21 Calculates the 21-period exponential moving average, highlighting short-term trends.

SMA 50 Averages the price over 50 periods, showing medium-term trends without overemphasizing recent data.

SMA 200 Averages the price over 200 periods, revealing long-term trends by treating all data equally.

Pivot price is the optimal buy point of a stock is defined as the moment it transitions from a stable basing area or chart pattern and begins to achieve new highs in price.

Industry Rank Investor’s Business Daily’s system that ranks industries 1 to 197 based on performance. It guides us in CAN SLIM TRADING towards leading sectors.

U/D Ratio Measures stocks closing up versus down. A ratio above 1.0 indicates bullish sentiment, important in CAN SLIM TRADING.

RS Rating Ranks a stock’s performance on a 1 to 99 scale. I look for at least 85, showing strong momentum and growth potential.

RS Line Compares stock price to the market, plotted as a ratio. We seek an uptrend, indicating outperformance and strong momentum.

Volatility Measures how much a security’s price fluctuates over time. High volatility means large price changes, indicating risk and potential reward.

Institutional Ownership Trend indicates whether the stock is under accumulation or distribution by the institutions.

EPS (Earnings Per Share): A financial metric calculated by dividing a company’s net profit by the number of its outstanding shares. It indicates the amount of profit attributed to each share of stock, serving as a key indicator of a company’s profitability.

11 Fast Ways to Enrich Your Portfolio | Your Essential Watchlist

STAGE 1: BASING OR BOTTOMING STAGE

Definition: A period following a stock’s decline where it starts moving sideways, forming a base. This stage signifies the easing of downward pressure and the beginning of stabilization, indicating that the stock is not in an uptrend yet but is preparing for potential future growth.

STAGE 2: ADVANCING OR UPTREND STAGE

Definition: The phase in which a stock breaks out of its base on significant volume, indicating a strong buying interest and the initiation of a new uptrend. This stage is considered the most opportune time for investors to purchase the stock, as it is expected to achieve substantial gains.

STAGE 3: TOP OR PEAKING STAGE

Definition: A stage characterized by the stock beginning to exhibit signs of losing momentum after its upward movement. The stock may start to move sideways with increased volatility compared to Stage 1. This suggests the stock might be reaching its peak, and the existing uptrend could be weakening.

STAGE 4: DECLINING OR DOWNTREND STAGE

Definition: This final stage occurs when the stock breaks down from its Stage 3 pattern and enters into a downtrend, marked by a sequence of lower lows and lower highs. It signifies that selling pressure has surpassed buying interest, usually serving as a signal for investors to sell the stock to mitigate further losses.