Just two days ago, on January 10th, I embarked on a significant investment journey by acquiring Amazon (AMZN) stocks at $153.40 per share. As I reflect on this decision, I aim to provide a thorough examination of the market conditions surrounding AMZN at the time of purchase and delve into the intricate factors that influenced my decision-making process.

Market Overview:

In the current landscape, the broader market is riding an optimistic wave, characterized by a discernible uptrend that has engulfed a majority of stocks. AMZN stands out by outperforming approximately 92% of the stocks in the S&P500. This positive momentum is reinforced by the fact that AMZN is trading above key moving averages, a reliable indicator of an upward trend.

Analyzing the Chart:

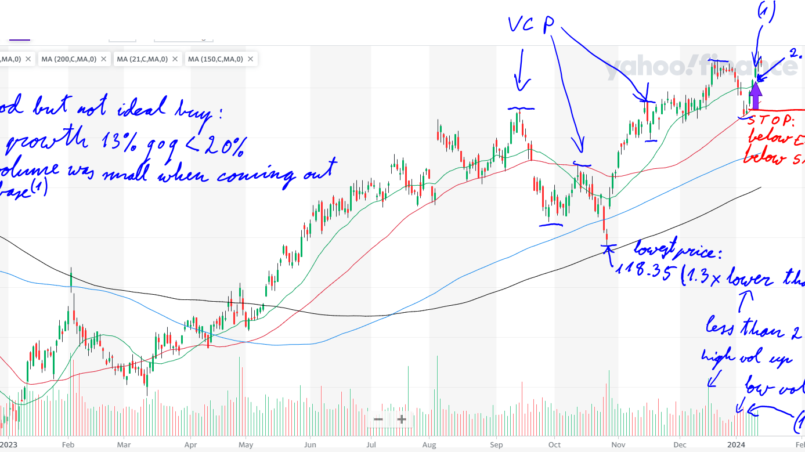

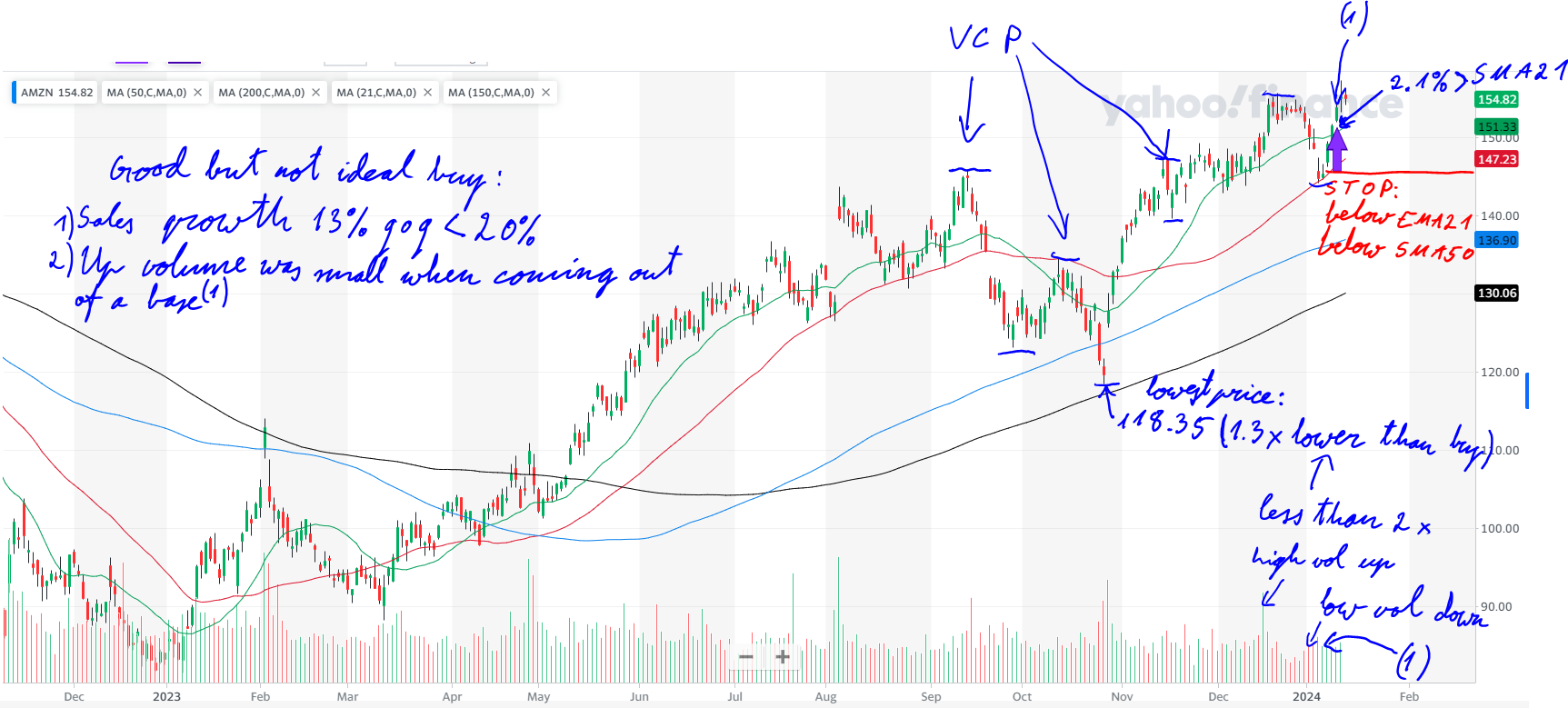

To provide readers with a visual understanding of the situation, I’ve incorporated a graph adorned with my handwritten annotations. The journey of AMZN’s price unfolded dramatically, with a peak in September 2023 followed by a series of pronounced down days. The subsequent bounce and eventual bottoming on October 26th, 2023, marked a turning point.

Volatility Contraction Pattern (VCP):

Since then, the stock has exhibited a consistent upward trajectory, interspersed with occasional downturns. Notably, the volatility of the stock’s price has seen a contraction, a phenomenon highlighted by the ‘VCP’ (Volatility Contraction Pattern) areas I’ve marked. This contraction suggests that the market has possibly settled on a definitive price pattern, with the stock appearing to be under accumulation.

Factors Influencing the Decision:

While my purchase of AMZN wasn’t perfect, several crucial factors influenced my decision:

1. Sales Growth:

The most recent sales growth reported was 13%, falling short of the expected 20%. This disparity suggests a slower growth rate than desired.

2. Breakout Volume:

When the stock broke out of its base, the accompanying volume failed to impress. Ideally, a breakout should be accompanied by daily volume at least 40% higher than the average; however, in this case, it was only 3% higher.

Additional Considerations:

In addition to the primary influencing factors, there are several other elements that played a role in shaping my analysis:

Proximity to Moving Averages:

I have a preference for buying stocks when their prices are in close proximity (within a 3% range) to EMA-21 or SMA 50. These levels often act as reliable support or resistance lines. In this particular instance, the stock’s price was 2.1% higher than EMA-21.

Lowest Base Price Comparison:

Another criterion I consider is comparing the lowest price of the last base to my buying price. I feel more secure when my buying price is a maximum of twice as high as the lowest price. At this juncture, the buying price was 1.3 times higher than the lowest base price.

Conclusion:

In conclusion, while my purchase of AMZN may not have been an exemplar of an ideal trade due to the challenges posed by lower-than-expected sales growth and subdued breakout volume, various indicators suggest that it was still a reasonably good buy. It’s important to emphasize that no investment comes with a guarantee, and these analyses serve as tools to shape informed opinions. The trajectory of AMZN’s future performance will be revealed only with the passage of time. Until then, the market remains an ever-evolving canvas, painting the story of each stock and investment decision.