Embarking on a captivating journey through the ever-evolving financial landscape, I am thrilled to provide you with a comprehensive overview of my latest watchlist. Rooted in the principles of the renowned CAN SLIM criteria, or its close counterparts, this watchlist is a culmination of thorough research and analysis. Before we delve into the intricate details of each stock, it’s important to emphasize that the insights shared here are not financial advice. I am not a seasoned professional, and the stocks discussed are not presented as buying recommendations. The information is purely for educational and informational purposes.

The Latest Ready-To-Go Watchlist:

Allow me to present my meticulously curated Ready-To-Go watchlist, thoughtfully arranged based on previous performance from the most favorable to the least:

- MHO

- FOR

- PHM

- GFF

- TOL

- KNF

- FIX

- IR

A brief note: The dynamic nature of the market led to the removal of DDOG from this list, finding a new home in my ‘Trades 2024’ and ‘Portfolio’ lists.

Analyzing the Picks:

MHO:

- The trajectory of MHO’s stock price is unmistakably upward, comfortably residing above all key moving averages.

- The proximity to EMA-21 is advantageous, offering a relatively tight stop-loss placement.

- An impressive feat as it outperforms approximately 98% of securities in the S&P 500.

FOR:

- FOR showcases a robust uptrend, surpassing 98% of the market.

- Key observations:

- Volatility Contraction Pattern (VCP) is evident.

- Tight price action at the base signifies a decline in selling pressure.

- Notable price advances accompanied by high volume.

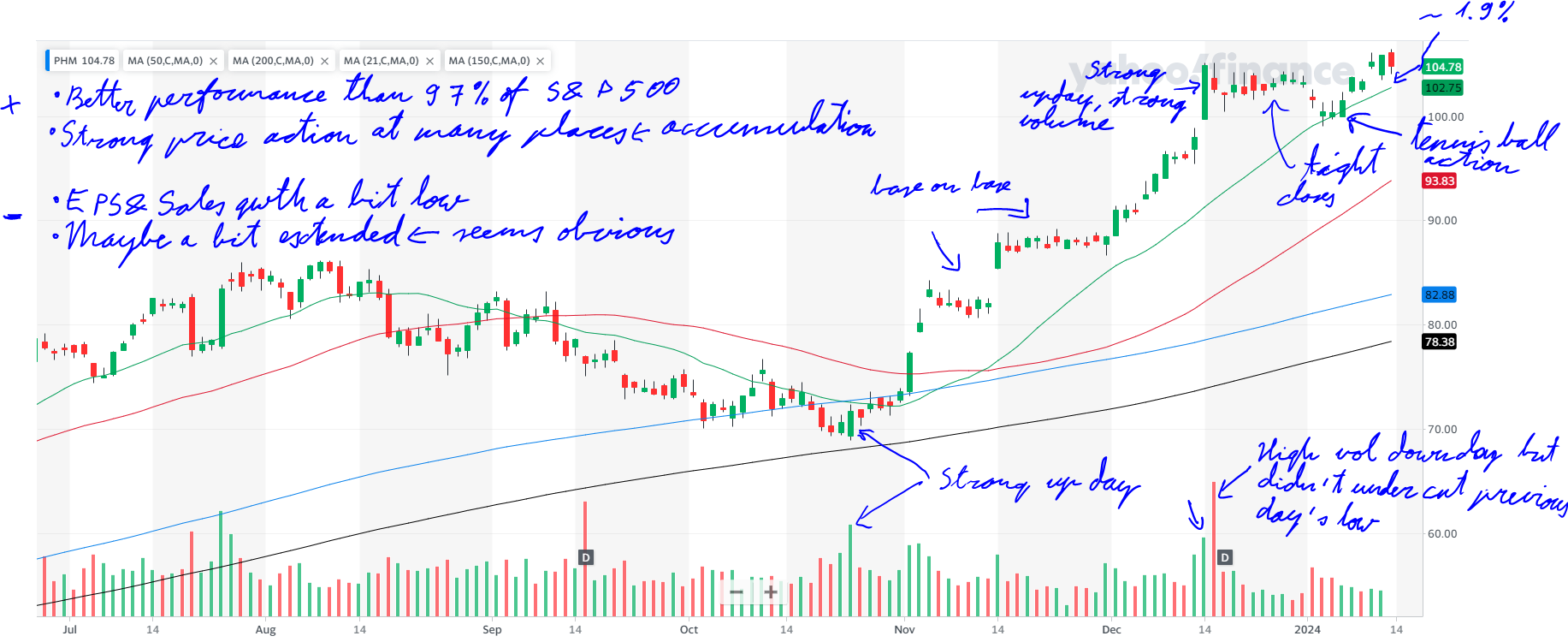

PHM:

- Exhibiting robust price action, PHM introduces the concept of ‘tennis ball action.’

- An outperformer, besting 97% of the overall market.

- Positive indicators:

- Strong up days paired with high volume.

- A decrease in volatility over time.

- Areas of concern:

- Quarterly EPS & sales growth slightly below the desired threshold at 8% and 3%, respectively.

GFF:

- GFF boasts a steady uptrend with a recent return to the EMA-21.

- Tight price action compensates for historical volatility.

- Despite declining sales and slightly low EPS growth, it still outperforms 96% of the market.

TOL:

- In close proximity to EMA-21 with recent tight price action.

- Indicates signs of accumulation.

- While not a CAN SLIM stock due to negative EPS and sales growth, it may present a good trade opportunity.

KNF:

- Limited price action history since May of the previous year, but promising signs.

- Recent volatility without a notable breakdown.

- Currently trading near EMA-21.

FIX:

- Identified as a CAN SLIM stock and evidently under institutional accumulation.

- Noteworthy uptrend longevity, with the last dip below SMA 200 occurring in 2022.

- Thinly traded, but currently showing signs of institutional accumulation.

- Trading near EMA-21, with SMA-50 not far off.

IR:

- Almost a CAN SLIM stock, with 15% sales growth.

- Tight price action at the bottoms of the bases, indicating potential strength.

- A relatively recent uptrend since November last year.

SPY and QQQ:

- Both SPY and QQQ, according to key moving averages, exhibit an uptrend, signaling a positive climate for stock purchases.

- It’s crucial to note that while the overall market trends positively, unforeseen events can impact outcomes.

SPY chart:

Additional Insights and Considerations:

Now, let’s delve even deeper into some overarching insights that guide my stock selection process and considerations that go beyond the technical aspects.

Guiding Principles in Stock Selection:

CAN SLIM Criteria:

The foundation of my watchlist lies in the esteemed CAN SLIM criteria, a methodology developed by William J. O’Neil. This approach emphasizes the following key factors:

- C – Current Earnings: Companies should demonstrate a strong track record of increasing current quarterly and annual earnings per share (EPS) by at least 25%.

- A – Annual Earnings: A company should exhibit consistent annual earnings growth of at least 25% in recent years.

- N – New Products or Services: Innovations and new product offerings often drive a company’s success.

- S – Supply and Demand: A stock should have a limited supply, with increasing demand, often reflected in strong institutional buying.

- L – Leader or Laggard: Focus on stocks that lead in their industry sectors.

- I – Institutional Sponsorship: Companies with strong institutional support tend to be more stable and successful.

- M – Market Direction: Only invest in stocks that align with the current market direction.

Technical Analysis:

Beyond the fundamental criteria, technical analysis plays a crucial role in identifying optimal entry and exit points. Key indicators include moving averages, trendlines, and chart patterns, all of which contribute to a comprehensive assessment of a stock’s potential.

Risk Management:

While the allure of potential profits is evident, it is equally important to manage risks effectively. Here are some risk management principles that guide my decision-making:

- Position Sizing: Diversification is key. Never put all your eggs in one basket. Determine a percentage of your total portfolio that you are willing to risk on a single trade.

- Stop-Loss Orders: Set clear and strategic stop-loss orders to limit potential losses. This is a critical aspect of disciplined trading.

- Portfolio Diversification: A well-diversified portfolio helps spread risk and mitigate the impact of a single stock’s poor performance.

The Ever-Changing Market Dynamics:

Understanding that the market is dynamic and subject to various external influences is paramount. Economic indicators, geopolitical events, and global economic conditions can impact the performance of stocks and should be closely monitored.

Conclusion:

In navigating the financial seas, a comprehensive understanding of both technical and fundamental aspects is crucial. While the watchlist serves as a guide, it’s imperative to adapt to changing market conditions and remain vigilant. The insights shared here are for educational purposes, and no guarantees of future performance are implied.

As we embark on this journey together, may the financial seas be favorable, and the knowledge gained serve as a compass in the vast and ever-changing world of stock trading.