The main idea of this website is to document and showcase trading results—both the favorable and unfavorable outcomes.

I’ll be detailing the trades executed in one of my smaller trading accounts over the past few years. Now, you might be wondering why I limit myself to just a couple of thousand dollars. There are a few reasons behind this approach.

Firstly, my past experiences have made me quite risk-averse.

Secondly, CAN SLIM is a relatively new strategy for me, actively employed for just a couple of years. I firmly believe that strategies and ventures must demonstrate their worth before I’m willing to invest more substantially.

Thirdly, my goal is to demonstrate that this strategy is effective for rapidly growing a trading account. While trading fascinates me, I’m committed to becoming as proficient as possible. Essentially, this site serves as my public trading journal, which I hope proves beneficial for both you and me.

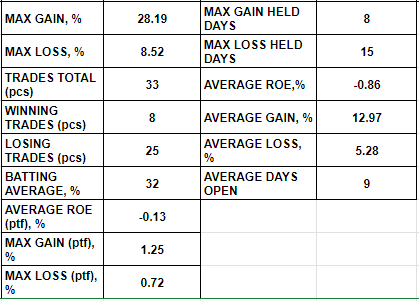

Over time, I’ll be sharing various statistics, analyses, and opinions regarding both successes and failures. Currently, the statistics paint a less-than-rosy picture, but I won’t sugarcoat the reality.

To sum up my 6-month period in 2022:

The summary reveals a higher number of losing trades compared to winning ones, resulting in a low batting average. Although market conditions could improve this figure, there’s no guarantee.

Batting average is a crucial aspect we can’t fully control, and it’s the primary reason for swiftly cutting losses—essential for both traders and investors to prevent financial setbacks.

Batting average is often misconstrued. People tend to believe it should be at least 50%, or even higher with strategic decision-making. However, my experience from 2022 until now falls short of those numbers. It could be a result of my limited experience, or perhaps market conditions also play a role. Only time will unveil the answer.