In this comprehensive blog post, I’m thrilled to share the latest updates on my investment portfolio. The market’s dynamic nature demands strategic adaptability, and my portfolio reflects a commitment to navigating these changes with precision. Unlike day traders who focus on rapid transactions, my investment strategy doesn’t confine itself to specific time frames. Instead, it pivots around crucial factors such as stop-loss and profit target levels.

Investment Philosophy: Beyond Time Constraints

Diverging from the quick-paced nature of day trading, my investment approach is characterized by a strategic evaluation of stocks based on performance metrics. The decision-making process revolves around meticulous analysis, offering the flexibility needed to respond to market shifts effectively.

Strategic Liquidation: A Rare But Essential Move

While I typically maintain a long-term perspective on positions, there are instances when I opt for strategic liquidation. This decision is rooted in a lack of movement over an extended period, usually exceeding a month. The capital reallocation strategy ensures a continual search for the most promising opportunities.

Current Holdings: A Performance-Based Ranking

Here’s a curated list of the securities currently gracing my portfolio, organized based on their price performance, starting from the most favorable:

- CRWD

- DDOG

- ETN

- AMZN

- COR

- V

In-Depth Analysis of Holdings

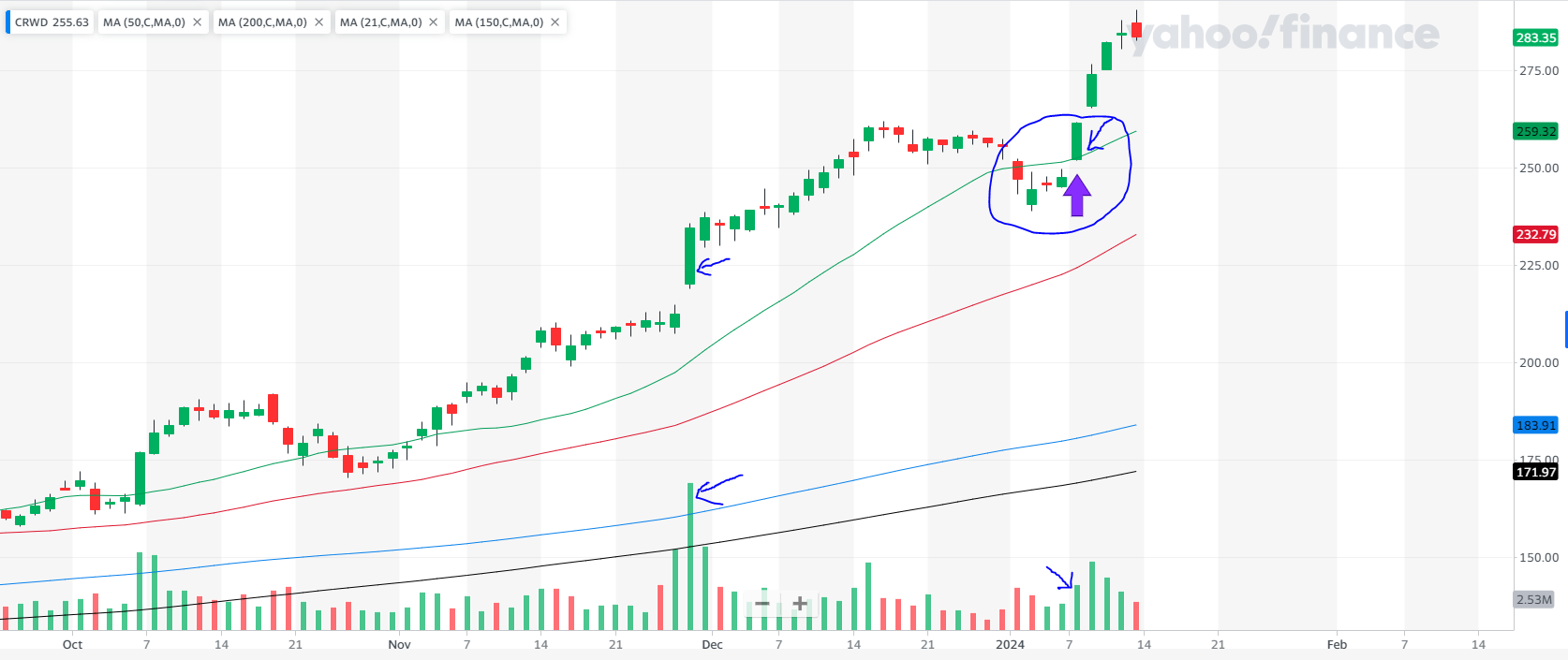

1. CRWD: Riding the Momentum

- Open: 8 Jan 2024

- Price: $260.90

- Profit Target: $315 area

- Stop-Loss: $245 area (below EMA-21)CRWD stands out as a CAN SLIM stock that caught my eye when it broke above EMA-21 with substantial volume. The trade is currently profitable, bolstered by strong upward movements, particularly highlighted by arrows in late November 2023. While such opportunities are infrequent, this trade exemplifies the events I actively seek in the market.

When maintaining a position that has experienced rapid gains and boasts a considerable unrealized profit, exercising additional patience is essential to avoid quick liquidation. If the position accrues more than a 20% profit in less than 3 weeks, the rule stipulates that I must keep the position open for at least 8 weeks. Let’s hope this scenario unfolds.

2. DDOG: Capitalizing on Key Levels

- Open: 12 Jan 2024

- Price: $122.37

- Profit Target: $147 area

- Stop-Loss: $115 area (below EMA-21)Another CAN SLIM addition to my portfolio, DDOG, was introduced recently. EMA-21 has proven to be a crucial level for this stock, as evidenced by the chart with arrows. The stop-loss is strategically placed below EMA-21, providing a robust risk management strategy.

I purchased this one on the evening of January 12th. While constructing my Ready-to-Go watchlist, it emerged as a strong candidate. Upon realizing that all the necessary indicators for taking action were green, I decided to take a position. As the saying goes, ‘Shoot first, ask questions later.’

3. ETN: Balancing Growth Potential

- Open: 20 Dec 2023

- Price: $237.98

- Profit Target: $285 area

- Stop-Loss: $221 area (below EMA-21 and SMA-21)ETN, while not a pure CAN SLIM stock due to lower sales, showcases significant growth potential. The decision to buy was influenced by a breakout from a tight trading base, although the trade faced challenges due to lower breakout volume. Notably, EMA-21 continues to play a pivotal role in supporting the price action.

4. AMZN: Industry Giant with Strategic Entry

- Open: 10 Jan 2024

- Price: $153.40

- Profit Target: $185 area

- Stop-Loss: $142 area (below EMA-21 and SMA-21)Amazon, a household name, was added to my portfolio as it broke above EMA-21 within a base. The proximity of SMA-50 provided an additional layer of support, contributing to effective risk management.

There is something captivating about famous names like AMZN, GOOGL, AAPL, etc. I find myself consistently drawn to them. Even if they don’t qualify as CAN SLIM names at the given moment, I am subconsciously seeking reasons to incorporate them into my portfolio. Fortunately, I have maintained enough discipline to divest from positions when they begin to move against me.

5. COR: Timely Entry and Market Uptrend

- Open: 07 Nov 2023

- Price: $196.93

- Profit Target: $225 area

- Stop-Loss: $185 area (below EMA-21 and SMA-21)Approaching the two-month mark, COR seems poised to reach its profit target. The decision to buy was influenced by the stock being in the buy zone and an overall market uptrend. However, hindsight suggests a potential improvement in timing the purchase for better pricing.

6. V: Patience Amidst Underperformance

- Open: 21 Nov 2023

- Price: $253.32

- Profit Target: $310 area

- Stop-Loss: $239 area (below EMA-21 and SMA-21)While not a CAN SLIM stock, V remains in my portfolio despite underperforming. The position, almost two months old, is currently being monitored closely. Should the stock show signs of decline, immediate action will be taken, emphasizing a proactive approach to risk management.

General Portfolio Insights

Scarcity of CAN SLIM Stocks

The current portfolio exhibits a scarcity of CAN SLIM stocks, a criteria I consistently seek. However, flexibility in my approach allows for exploration of other companies displaying promising potential.

Sector Neutrality and Position Sizing

At present, I maintain sector neutrality and do not mind being overweight in a particular sector. Position sizes are carefully managed to hover around 10% of the portfolio, a deliberate strategy to minimize the impact of losses.

Evolution of Trading Strategies

While I currently lack sector preferences, this may evolve as my trading strategies mature. Adaptability is a cornerstone of successful investing.

Position Sizing Strategies

I adhere to a position sizing strategy that involves initiating positions at around 5% of the portfolio. As a trade progresses positively, I consider increasing the position size to 10%, following the common CAN SLIM trading approach.

Managing Open Positions: A Tactical Approach

Closely monitoring open positions is crucial to my strategy. I consider closing a position if it experiences three or four consecutive down days or falls below key moving averages like EMA-21 or SMA-50. Immediate exit is mandatory if the stock breaches the SMA-200 threshold. Additionally, variations in volume during advances and declines are key indicators for deciding whether to retain or exit a position.

Acknowledging Imperfection: A Pragmatic Approach

In conclusion, the acknowledgment of potential errors in decision-making is crucial. While initially challenging to the ego, prioritizing portfolio protection over personal pride has proven effective. The journey is not without its learning curves, but the ultimate goal is to foster a resilient and adaptive investment strategy.

Continuous Learning: A Key Component of Success

As an investor, the commitment to continuous learning is paramount. Each trade, successful or not, contributes to refining strategies and adapting to the ever-changing market conditions. It’s this iterative process that distinguishes successful investors from the rest.

This comprehensive overview provides an in-depth look into the intricacies of my current portfolio and the strategic considerations that guide my decision-making process. As the market landscape continues to evolve, stay tuned for further updates and insights.