Introduction

In the dynamic world of stock trading, not every decision pans out as expected. My recent trade with Gimbal Electronics (KE) from September 1st to the 7th, 2023, serves as a potent reminder of the intricate dance between risk and reward.

Opening Maneuvers

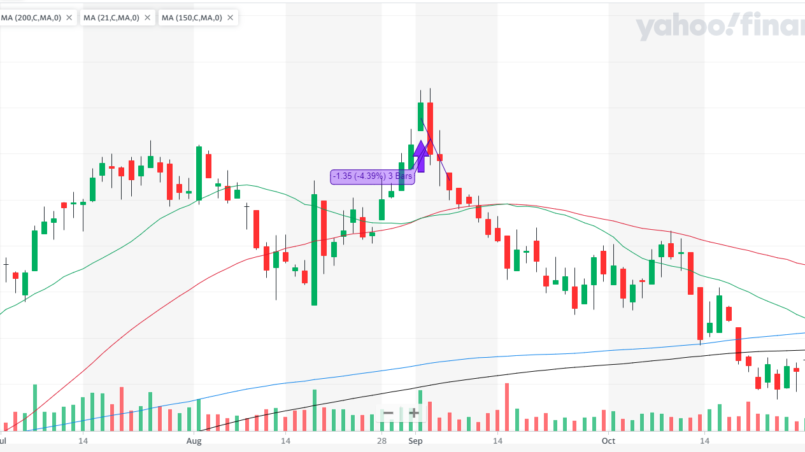

- Opening the Position: On September 1st, I entered the trade at an optimistic price of $30.78.

- In the Buy Zone: Despite being in the buy zone, I noticed the volume was not convincingly high, which should have been my first hint to proceed with caution.

The Retreat

- Closing the Trade: Ultimately, I exited the position on September 7th, a day marked by the fourth consecutive downtrend, at a selling price of $29.18.

Reflections on the Battle

- Tactical Successes:

- I took preventive action when the price reached the EMA-21.

- By selling manually, I avoided hitting the stop-loss point, which would have resulted in a more significant loss.

- Strategic Missteps:

- The significant drop the day after my purchase was a clear signal to exit the trade, which I initially overlooked. I should have sold immediately.

- The market outlook became worse therefore I should have taken defensive action more quickly.

- I should have noticed the volatile price action in the previous base.

- I should have taken into account the fact that the stock was thinly traded. It is always better to trade stocks that have an average daily volume higher than 400,000 shares.

Tactical Review and Strategy Enhancement

In hindsight, the trade exposed some critical areas for improvement:

- Volume Analysis: The insufficient volume was a significant oversight. A stronger volume would have indicated a more robust conviction from the market, potentially validating the entry point.

- Early Warning Signs: The substantial dip following the purchase was a red flag that warranted immediate action. In the future, such signs should trigger a quicker exit to minimize losses.

Closing Thoughts

This trade, despite its shortcomings, has been a valuable exercise in refining my approach. Each trade shapes my strategy and hones my decision-making skills, reinforcing the need for vigilance and responsiveness to market signals.

This trade resulted in a 7.75% loss, which was one of the largest losses I incurred last year and across my overall CAN SLIM trading period. One aspect I am proud of, however, is the discipline and resolve I maintained to close the position when the trade went south.

This trade is a prime example of what not to do.