My Trading Journal: The COR Stock Investment Journey

Part 1: The Setup and Initial Strategy

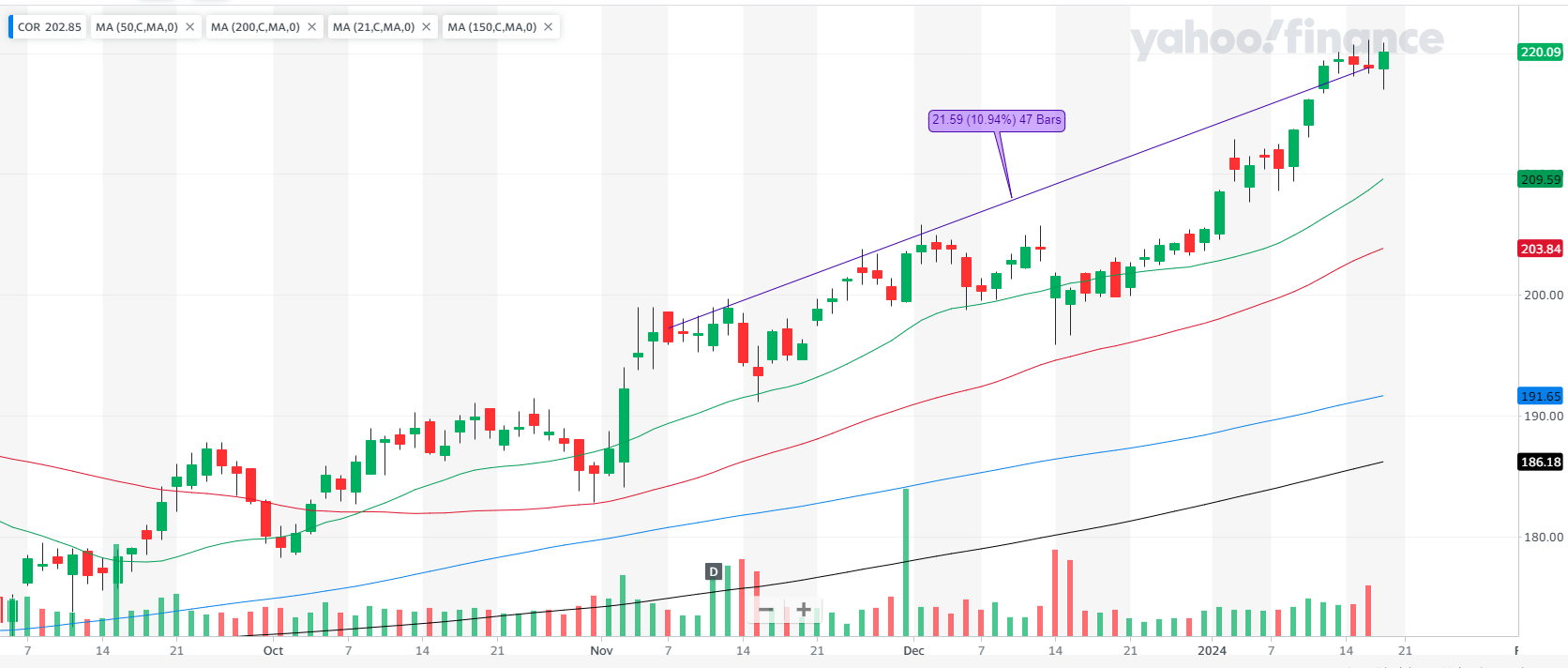

Date of Purchase: November 7, Last Year

On November 7 of the previous year, I embarked on a strategic investment in the stock market. This post details my journey with COR stock, offering insights into the thought process and strategy behind the investment.

Initial Purchase Details

- Stock Acquired: COR

- Purchase Price: $196.93 per share

Investment Strategy

- Stop Loss Strategy: Set at $187.78 to mitigate risk

- Profit Target: Aimed for $221 for substantial return

- Market Outlook: Confirmed uptrend, indicating a favorable investment environment

- Price Multiplier*: $196.93 / 171.70 = 1.1

* $ 171.70 is the lowest price in the previous base. I prefer my purchasing price the maximum of twice as high as the multiplier price. Otherwise the stock would seem too expensive.

Repetition and Emphasis

A key aspect was the repeated emphasis on market’s uptrend status and the fact that the stock outperformed 91 % of the stocks in the market.

Another important fact was that the stock price was in the buy zone which made it a safer bet.

Part 2: Closing the COR Trade – Analysis and Reflections

Trade Summary

On January 17, 2024, I closed my position in COR at a price of $221. Despite a slight decline in the RS rating to 88, the market conditions and PE multiplier at 1.29 remained in my favor. The closure was executed via a limit order at my profit target.

Key Metrics

- Return on Equity: 11.15%

- Portfolio Impact: 0.99%

- Trade Duration: 47 trading days (71 calendar days)

What Went Well

I am particularly proud of maintaining discipline and sticking to the planned exit strategy. This discipline was crucial amidst fluctuating market conditions.

When I made the purchase decision, the chart was read correctly. I observed that the price was in an uptrend and that the stock price had broken out of a base on high volume.

The stop-loss was placed into the base area of the stock price which gave it a enough room to move.

Areas for Improvement

Reflecting on the trade, I recognize areas for optimization:

- Setting a Higher Sell Order: The profit target, though achieved, was slightly conservative. Aiming for a 20-25% profit as per Can Slim strategy could have maximized returns.

- Timing the Entry: The entry point was within the buy zone but not optimally timed. An earlier entry at a more accurate pivot price would have enhanced profits.

- Adding to the position: That could have been an option around the $203 price range, but I already held a position close to 10%, so increasing it further would have been excessive.

Conclusion

This COR trade was an invaluable learning experience, underscoring the importance of adhering to a plan and the necessity to adapt strategies in response to market dynamics and personal performance assessments. The balance between discipline and adaptability continues to be a pivotal aspect of successful trading.

Personal Reflection

Overall, I am quite satisfied with the outcome of this trade. Achieving more than a 10% profit over a span of just two months is a significant accomplishment. Additionally, this experience reinforced a crucial lesson: trading becomes considerably more manageable when the market direction is favorable. Riding the wave of a confirmed uptrend not only bolstered my confidence but also contributed to the success of this trade. It’s a reminder that timing and market conditions play a crucial role in the art of trading.