In the realm of trading, the tendency to discuss victories rather than defeats is prevalent, especially during bull markets. However, it’s essential to acknowledge that trading isn’t always a journey of consistent success. My personal experience over the last two years serves as a testament to this reality.

The Harsh Reality of Trading

The past year has been particularly challenging, with consistent downward trends in my trading outcomes. This period starkly contrasts with the typically glorified narratives of trading successes. In my experience, when the markets are flourishing, the majority of stocks also perform well, making it seemingly easy to profit. Such situations can dangerously inflate a trader’s confidence, leading to a sense of invincibility. I, too, have been guilty of this in the past.

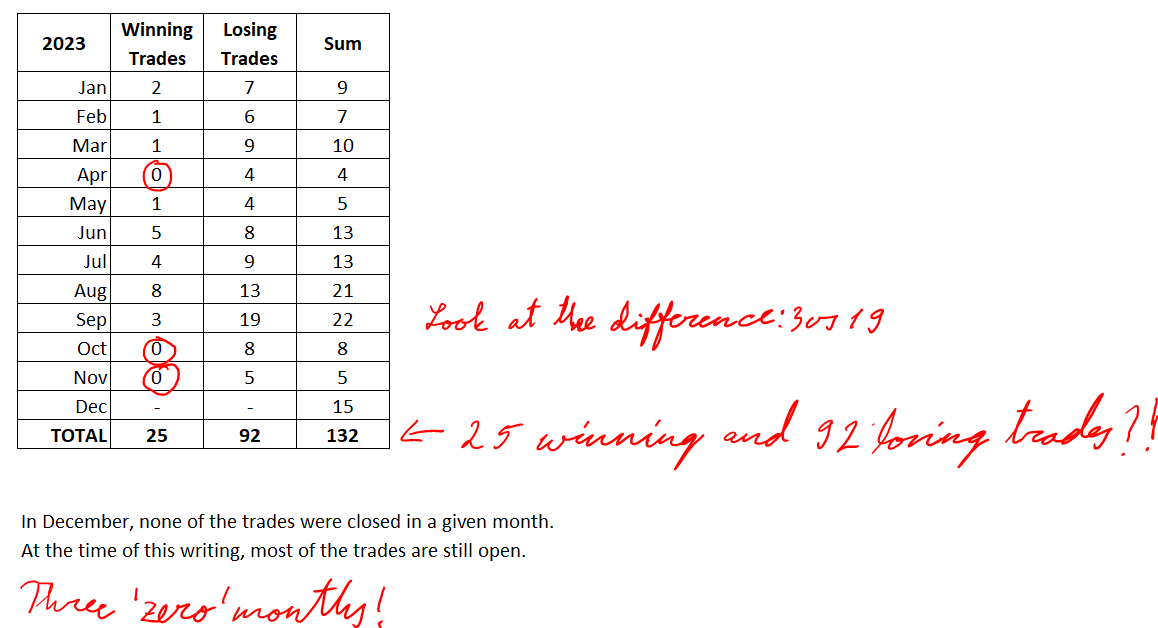

Down below, is an overview of my monthly statistics:

As you can see, there were no months that had more winning trades than losing ones. This is an illustration of the myth that when you pick randomly, about 50 % should be profitable.

Markets are much more complex than just ‘heads or tails’.

Learning from Losses

However, the last two years have painted a different picture. The markets have faced significant downturns, and as a result, the enthusiasm among stock traders has dwindled. My trading during this period has been characterized by more losses than wins, with the former often outweighing the latter. This scenario illustrates the vital importance of stop-loss strategies, not just for individual stocks but for one’s entire portfolio.

Implementing Stop Losses

Initially, I set a monthly portfolio stop loss at 6%, later reducing it to 3%. This meant halting all trading activities if my net value dropped by more than 3% within a month. Such strategies are crucial in challenging market conditions. They are akin to exit strategies, which could involve closing trades after consecutive days of losses, significant volume drops, or changing market conditions.

Statistical Insights and Discipline

Despite careful trade selection, my portfolio still experienced a 13% overall decrease over a year. This decline, though seemingly modest given the 92 losses to 25 wins ratio and larger loss sizes, signifies disciplined trading. I consistently honored my stop losses, which played a crucial role in minimizing potential damages.

Shifting Perspectives: From Profit to Improvement

This journey has shifted my perspective on trading. Rather than prioritizing profit, my focus has turned to improvement and ‘cracking the code’ of trading. This approach is akin to a scientist seeking discovery rather than financial gain. My experience suggests that a money-chasing mindset might not align with sustainable trading practices.

With that being said, it is still important to remember that the approach to trading needs to be like an approach to any other business. Stocks are just a merchandise.

Success in Adherence to Plan

Despite being unprofitable, I consider my experience successful because I adhered to my trading plan. The journey has been fraught with miscalculations, excessive optimism, and a tendency to trade volatile stocks. Yet, my adherence to my plan and avoidance of large bets were key to staying afloat.

Conclusion: Resilience in Trading

Trading is not just about making money; it’s about learning, adapting, and persisting. Even through a challenging year, the discipline in adhering to pre-set rules and the resilience to continue despite setbacks are what define true success in trading. It’s about staying in the game, learning from each experience, and preparing for the next opportunity. This journey, though fraught with challenges, is a testament to the importance of discipline, strategy, and the continuous pursuit of improvement in the unpredictable world of trading.