Introduction: The Stage is Set

Welcome to the world of trading, where the blend of analysis, strategy, and emotion forms the canvas of the financial markets. Today, we’re peeling back the curtain to reveal a snippet of this world through a detailed trade review. Our focus is on a specific transaction involving ZS stock, initiated on the 9th of October, 2023, and concluded on the 20th of October, 2023.

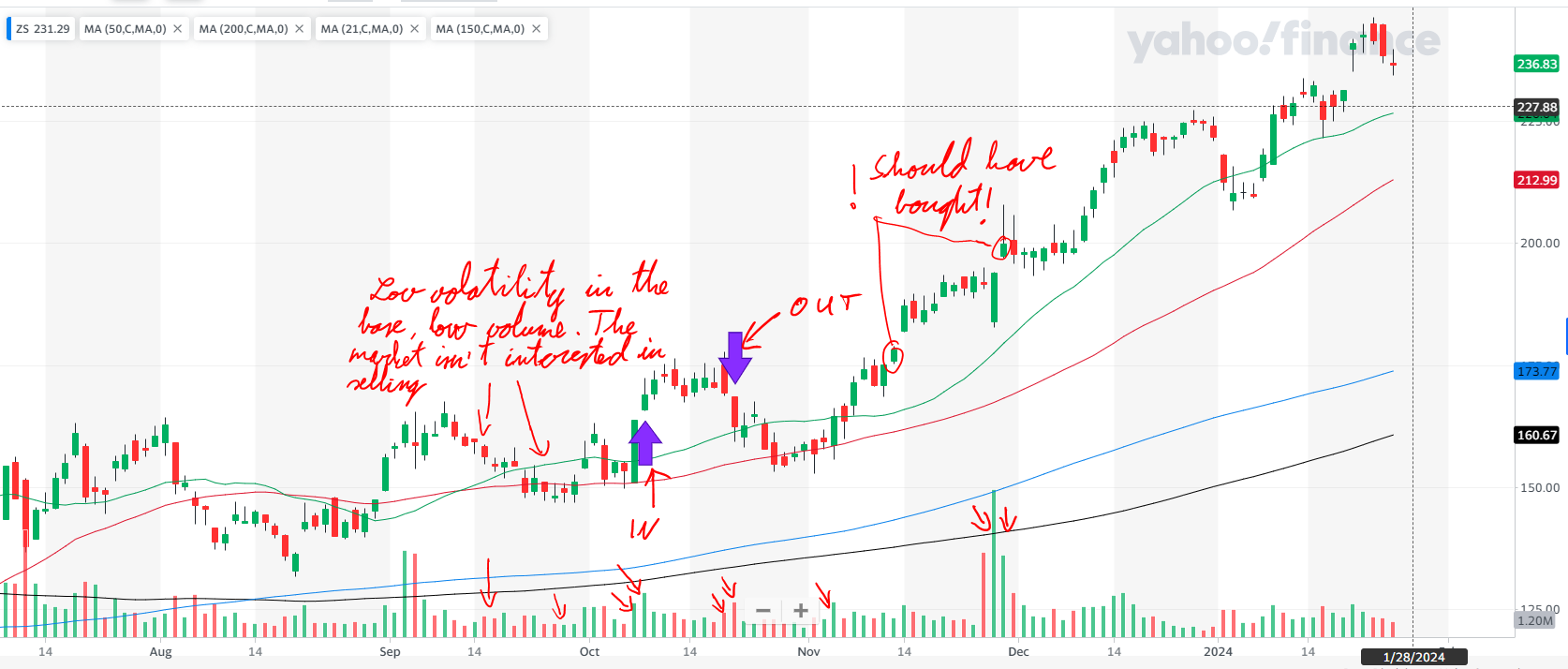

In this blog post, we’ll dive into the reasoning behind the trade opening, the market conditions that warranted a close, and the outcome that followed. We’ll dissect the elements of the trade, from the opening price to the stop-loss settings, and from the market outlook to the final return on equity. Moreover, we’ll reflect on the lessons learned, evaluating both the successes and the areas ripe for improvement.

Join us as we navigate through the decision-making process, the fluctuations of the market, and the insights gained from this trading journey. Whether you’re a seasoned trader or new to the market, there’s wisdom to be found in examining the real-life application of trading principles. Let’s begin our exploration of this trade’s narrative and extract valuable lessons that can sharpen our strategies for future endeavors.

The Opening Move: Setting the Stage for ZS

- Stock: ZS

- Opening date: 9 Oct 2023

- Opening price: $ 170.52

- Stop-loss: $ 166.99

- Profit target: $ 204.62

- Market Outlook (open): Confirmed uptrend

- Why did I open?: Price bounced up from EMA 21

- Remarks: Price a bit extended

The Turning Point: Decision Time

- Closing date: 20 Oct 2023

- Closing price: $ 166.39

- Closing RS: 96

- Market Outlook (close): Uptrend under pressure

- Why did I close?: Stopped out, also 3rd down day in a row. Price movement in sync with the market

The Outcome: Lessons in Numbers

- ROE pos, %: -3.57

- ROE portfolio, %: -0.27

- What went well?: Since I rised stop losses when the market got under pressure, the losses were small.

- What needs to be improved?: Selling at the right time but price advanced later. What is the best way to keep the stocks on the radar? This one doesn’t work well.

- Lessons learned: What is the best way to keep the stocks on the radar? This one doesn’t work well. RS can rise while the stock is falling.

Reflections: A Trader’s Insight

Once upon a market open, I found myself seated in my home office, the early morning sun casting a warm glow over the multiple screens arrayed before me. It was October 9th, 2023, a day that would etch itself into my memory not because of extraordinary gains or devastating losses, but for the lessons it would indelibly imprint upon my trading philosophy.

ZS had been on my watchlist for weeks. Its steady uptrend and promising technical indicators suggested a ripe opportunity. I remember how my finger hesitated for just a moment before I confirmed the buy order. The entry price of $170.52 was aligned with my strategy, just above the EMA 21—a beacon I often used to navigate the turbulent seas of the market.

Days passed, and I observed ZS with the vigilance of an eagle, noting its every dip and rise. My strategy was clear: maintain a stop-loss to safeguard against downturns and set a profit target that spelled a handsome reward. The stop-loss at $166.99, a number I had calculated with meticulous care, was my insurance policy. The profit target at $204.62, while ambitious, was not beyond the realms of possibility.

The market, however, has a notorious reputation for humbling even the most confident among us. As ZS began to waver, so did my certainty. By October 20th, it became apparent that the uptrend I had trusted was under pressure, the market’s mood had soured, and my stop-loss was triggered. I closed the position at $166.39, a tad below my stop-loss, a testament to the market’s swift and unforgiving nature.

Sitting there in the quiet aftermath, I felt the sting of a 3.57% loss in the position, a slight dent of 0.27% in my overall portfolio. But as I sipped my lukewarm coffee, I realized the market had offered me something more valuable than a profit—a lesson in humility and the importance of risk management.

Conclusion: Wisdom Gained

As we conclude our journey through the intricate dance of buying and selling within the stock market, the case of ZS provides us with valuable takeaways. Probably one of the most important takeaways is that I should have bought it back later.