Introduction: The Thrill of the Trade

Welcome to the exhilarating world of stock trading, where every decision is a blend of analysis, intuition, and a bit of daring. It’s a realm where numbers tell stories, and market trends often feel like riddles waiting to be solved. In this post, I’ll take you through my journey with three specific stocks – CBOE, ACGL, and AROC – sharing the whys, the outcomes, and the lessons learned.

market conditions

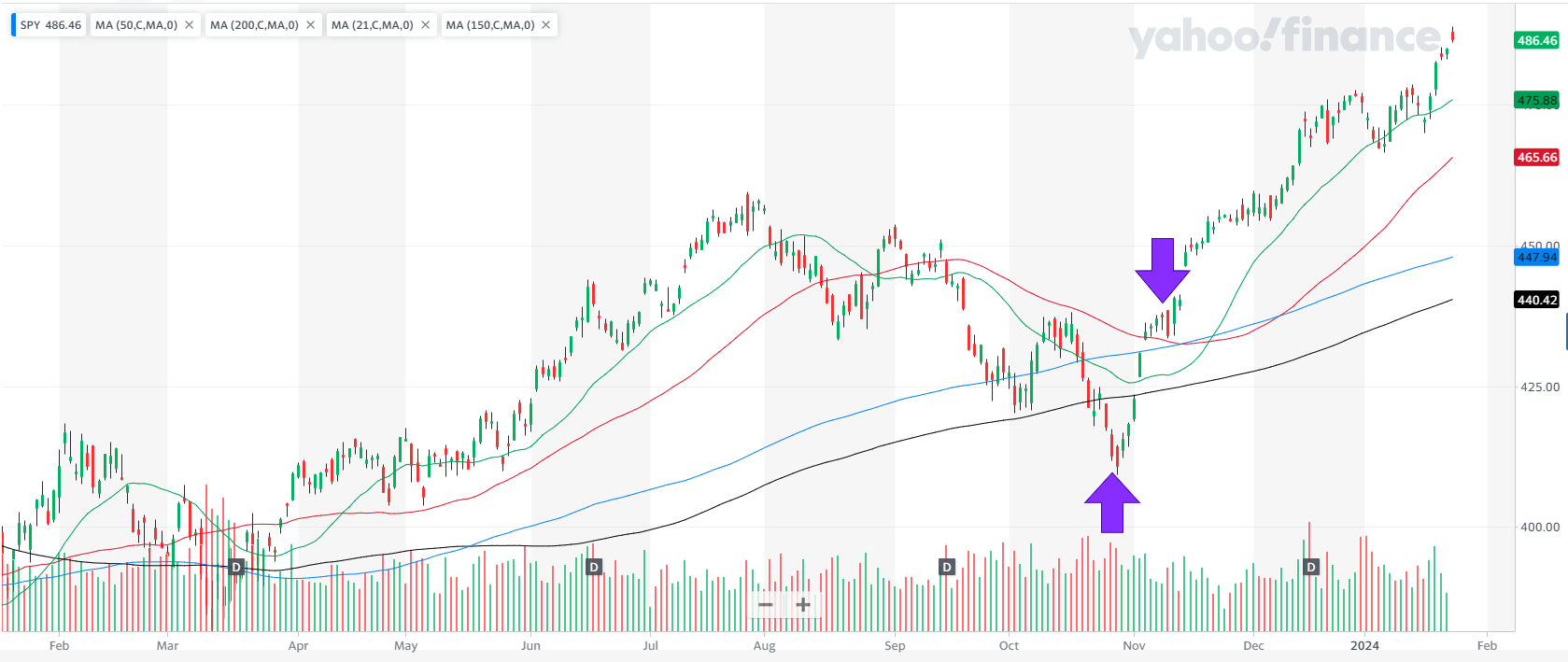

As I navigated through my recent trades, one thing became abundantly clear: timing the market is a pivotal yet challenging endeavor. During this period, the overall market was just beginning to recover from its lows, signaling a phase of bottoming out and an upward turn. This phase often presents unique opportunities for traders, but it’s accompanied by an inherent volatility that can lead to frequent stop-outs, even when you time the market correctly. The true understanding that the market is turning upwards is often only apparent in hindsight, making real-time decisions a complex blend of analysis and instinct.

To illustrate the precision of these decisions, the graph included below is marked with arrows that pinpoint the exact moments of entering and exiting the market. The upward arrow shows the point where I entered with the first position, identifying potential in the early signs of market recovery. Conversely, the downward arrow marks the last exit point, where either the volatility warranted a strategic withdrawal or the market conditions favored securing profits. These visual cues on the graph not only trace my journey through these turbulent market conditions but also reflect the delicate dance of timing in stock trading.

CBOE: A Dance with Market Trends

Opening Act: Choosing CBOE

Why did I open with CBOE? The stock displayed a promising upward trend in a tumultuous market. It was like finding a gem in the rubble – a sign of strength when everything else was uncertain. With an opening price of $164.44 and a stop-loss set at $158.79, I was ready to ride the wave.

The Twist: Closing CBOE

However, the market is full of surprises. I closed CBOE at $164.30, a decision triggered by a significant price drop. It was a narrow escape from a more substantial loss. This move taught me the importance of staying alert to market fluctuations and acting swiftly.

Reflections: Room for Improvement

The CBOE trade highlighted a crucial area for improvement: better understanding of earnings dates and market reactions. It’s not just about the numbers but also about the context in which those numbers exist.

ACGL: A Lesson in Market Dynamics

The Decision: Why ACGL?

ACGL’s opening move was driven by its upward trend during a down market, marked by a good price and strong upward volume. Opening at $86.52 with a stop-loss at $83.23, I was optimistic about its prospects.

Facing Reality: Why I Closed

The optimism was short-lived. Closed at $84.11, ACGL was a reminder that the market is unpredictable. The stock showed signs of weakness, closing below EMA 21 with multiple down days. It was a tough call but a necessary one.

Learning Curve: Improvements Needed

This experience underscored the need to keep the P/E multiplier low and to be more vigilant for Volatility Contraction Pattern (VCP) signs. Every stock has a story, and it’s essential to read between the lines.

AROC: Understanding Market Sentiments

The Attraction: Opening with AROC

AROC was an attractive pick due to its resilience in a downward trending market. An opening price of $13.69 with a stop-loss at $12.97 seemed promising, reflecting potential strength amidst market volatility.

Decisive Moments: Closing AROC

I decided to close AROC at $13.29 after observing the third consecutive down day. It was a decision based on the understanding that sometimes, it’s better to retreat and regroup.

Insights: Areas for Improvement

The AROC trade taught me the significance of not just numbers but also market sentiment and behavioral patterns. The focus should also be on P/E multipliers and recognizing early shakeout signs.

Detailed Trade Summaries

To provide a more in-depth perspective, here are the detailed summaries of each trade:

CBOE (Chicago Board Options Exchange)

- Opening Date: October 26, 2023

- Opening Price: $164.44

- Stop-Loss: $158.79

- Profit Target: $181.39

- Open RS (Relative Strength): 95

- Market Outlook (Open): Market in correction

- Closing Date: November 2, 2023

- Closing Price: $164.30

- Closing RS: 95.0

- RS Change: 0

- Market Outlook (Close): Confirmed uptrend

- ROE Position: -1.29%

- ROE Portfolio: -0.1%

ACGL (Arch Capital Group Ltd.)

- Opening Date: October 31, 2023

- Opening Price: $86.52

- Stop-Loss: $83.23

- Profit Target: $96.90

- Open RS: 94

- Market Outlook (Open): Confirmed uptrend

- Closing Date: November 8, 2023

- Closing Price: $84.11

- Closing RS: 93

- RS Change: -1

- Market Outlook (Close): Confirmed uptrend

- ROE Position: -4.9%

- ROE Portfolio: -0.19%

AROC (Archrock, Inc.)

- Opening Date: November 2, 2023

- Opening Price: $13.69

- Stop-Loss: $12.97

- Profit Target: $15.85

- Open RS: 96

- Market Outlook (Open): Confirmed uptrend

- Closing Date: November 8, 2023

- Closing Price: $13.29

- Closing RS: 95

- RS Change: -1

- Market Outlook (Close): Confirmed uptrend

- ROE Position: -5.41%

- ROE Portfolio: -0.17%

Conclusion: Lessons from the Trading Floor

Each trade – CBOE, ACGL, and AROC – was a chapter in my ongoing journey of learning and adapting. These experiences taught me the importance of context, the unpredictability of the market, and the need for continuous improvement. In stock trading, every decision is a step towards becoming a more astute and resilient trader. As I continue on this path, I am reminded that in the world of stocks, every loss and gain is an opportunity to grow, learn, and evolve.