Introduction

Navigating the stock market’s complex dynamics requires a solid strategy, keen insight, and a disciplined approach to risk management. In this blog post, I share an in-depth analysis of a successful trade involving COR, highlighting the critical decisions, strategies employed, and lessons learned throughout the process.

Strategy at a Glance

Our trading strategy emphasizes rigorous market analysis, identifying precise entry and exit points, and adhering to strict risk management protocols. The focus is on selecting stocks with high growth potential, underscored by robust relative strength (RS) and favorable market conditions.

Trade Initiation

The decision to initiate a trade involves several crucial considerations:

- Market Outlook: A trade is considered only when the market is in a confirmed uptrend, ensuring that the macroeconomic conditions support a bullish trajectory.

- Stock Selection: COR was selected for its promising potential, indicated by its positioning within the buy zone, suggesting an imminent upward movement.

- Relative Strength Indicator: With an Open RS of 91, COR demonstrated superior performance against 91% of the market, a bullish sign.

Numerical Overview of the Trade

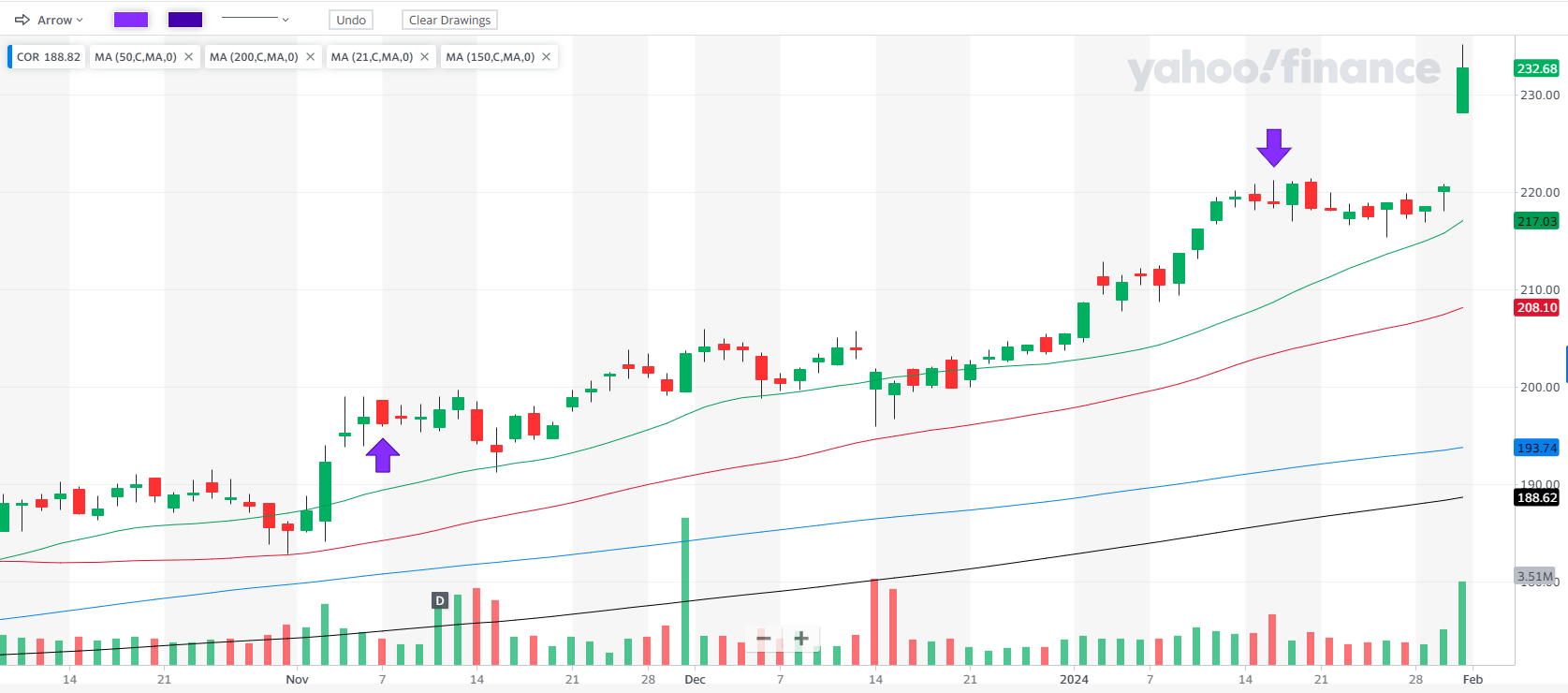

- Opening Date: November 7, 2023

- Opening Price: $196.93

- Stop-Loss: $187.76

- Profit Target: $221

- Open RS: 91

- Market Outlook at Opening: Confirmed uptrend

The Buying Decision

The decision to invest in COR was meticulously calculated, incorporating various factors that collectively indicated a high probability of success:

- Optimal Price Positioning: The stock’s price, positioned within the buy zone against the backdrop of a confirmed market uptrend, set the stage for a successful investment.

- Strategic Entry Point: The entry point at $196.93, coupled with a stop-loss at $187.76, was strategically chosen to minimize potential losses while targeting a profit of $221.

Managing the Trade

Effective trade management is pivotal from opening to closure:

- Adherence to Risk Management: A predefined stop-loss safeguarded trade against unexpected market downturns.

- Market Monitoring: Ongoing analysis ensured the trade aligned with the broader market conditions, which remained favorable throughout the trade duration.

The psychologically hard part is to see the stock price gapping up after closing the trade but this is part of the game. The most important is to stick to the plan. The price might as well be gapped down.

Discipline in Closing

A disciplined approach to closing is essential:

- Closing Date: January 17, 2024

- Achievement of Profit Target: The trade concluded successfully when COR reached the profit target of $221, affirming the strategy’s effectiveness.

- Closing RS: 88

- Change in RS: -3

- Market Outlook at Closing: Confirmed uptrend

- Return on Equity (ROE) Position-wise: 11.15%

- ROE Portfolio-wise: 0.99%

Insights and Lessons

The trade with COR offered valuable insights and reinforced several key lessons:

- Sell Order Placement: Reflecting on the execution, placing the sell order slightly higher might have captured additional gains, indicating room for improvement in future trades.

- Risk-Reward Balance: This trade reiterated the importance of balancing risk and reward, noting that conservative risk-taking often results in proportionate returns.

Optimizing Returns: The Art of Risk-Reward Ratio in Stock Trading

In this trade with COR stock, I focused on getting my numbers right, especially looking at how much I could lose versus how much I could gain. Here’s how I broke it down: I bought in at $196.93 and set my safety net (stop-loss) at $187.76. This meant I was only willing to risk losing around $9.17 for each share I bought. But, I was aiming to sell at $221, giving me a chance to make about $24.07 on each share. So, for every dollar I risked, I stood to gain $2.62. That’s like saying, if I’m okay with the chance of losing a dollar, I could end up making two and a half dollars back.

To me, that’s a pretty good deal. It shows I’m not just throwing my money out there and hoping for the best. I’ve got a plan. I chose my buying point, my safety net, and my goal carefully to make sure I was setting myself up for a good chance to make more money than I was risking. This kind of planning is what helps me sleep better at night, knowing I’m not just gambling. I’m making calculated moves.

Conclusion: Strategy Validation

This detailed analysis of the trade with COR validates the effectiveness of a well-planned strategy that combines thorough market analysis, disciplined entry and exit strategies, and an unwavering commitment to learning and adaptation. Sharing this experience aims to inspire and guide fellow traders toward refining their strategies, adopting disciplined trading practices, and achieving their financial goals.

The journey to trading success is marked by patience, discipline, and continuous education. Here’s to making informed decisions and thriving in the dynamic world of stock trading!