introduction

The stock market, a domain where fortunes can swing with the volatility of a pendulum, demands more than just a casual glance. It’s a realm where the disciplined thrive, and the unprepared find themselves adrift. As someone who’s navigated these waters, often with the grace of a cat on a skateboard, I’ve come to appreciate the nuances of making smart stock picks. Let’s delve deeper into two strategies that can guide even the greenest of investors to safer harbors.

The Zen of Tight Price Action

Understanding Tight Price Action

In the bustling world of stocks, finding ones that move with the predictability of a metronome is akin to discovering a peaceful island in a stormy sea. Tight price action refers to stocks that exhibit minimal daily price fluctuations. These stocks are the stoics of the market, unfazed by the hysteria that grips their more volatile counterparts.

The Virtues of Predictability

The allure of tight price action lies in its predictability. Holding a volatile stock is like trying to clutch a fish with your bare hands – it’s a slippery endeavor that can end in frustration. By choosing stocks with tight price action, you’re opting for a steadier journey, reducing the likelihood of being caught off-guard by sudden market swings.

The Strategy of the Cup and Handle

The Cup and Handle Unveiled

Venturing further, the cup and handle pattern emerges as a beacon for those seeking signs of forthcoming ascents. This pattern, reminiscent of a tea cup viewed from the side, signals a stock’s readiness to embark on an upward trajectory. The key lies in the handle’s position; perched high on the cup, it whispers promises of stability and potential growth.

The Importance of a High Handle

A high handle in the cup and handle pattern is the stock market’s equivalent of a green light. It suggests that the stock has weathered its recent dip with grace, steadying itself for a potential breakout. Low volatility here is the golden ticket, indicating that the stock is not gearing up for a freefall but rather consolidating its strength for a leap forward.

Navigating the Market with Precision

The Art of Setting a Stop-Loss

In the dance of buying and selling, setting a precise stop-loss level is your safety net. It’s a challenging endeavor, particularly with volatile stocks. The paradox lies in the necessity of a tighter stop-loss for more volatile entities. This controversial approach underscores the importance of picking the right entry point – a misstep can mean the difference between a strategic retreat and a hasty surrender.

The Crucial Role of Discipline

The market is unforgiving, and discipline is the armor that protects you from its caprices. With volatile stocks, the demand for discipline escalates. Every decision, from choosing an entry point to setting a stop-loss, requires a higher degree of control and adherence to your trading strategy. Without discipline, the market’s turbulence can easily sway your course, leading to decisions driven by panic rather than prudence.

details at a glance

weekly chart

The difference between the high and the low of the base was almost 50%. It’s way too much.

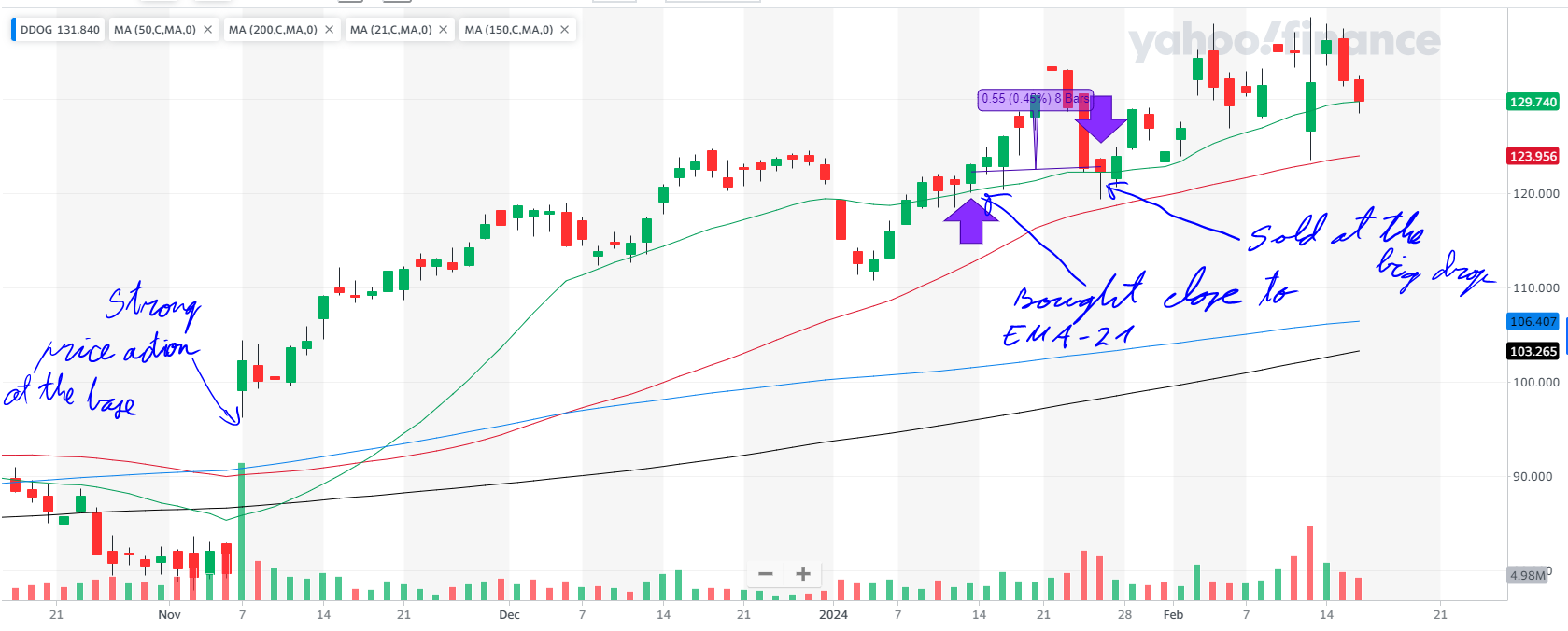

Purple arrows on the drawings represent the buying and selling places.

daily chart

As you can probably assume, I was allured by the strong price and volume action (pointed out on the left side of the drawing). This was the main reason for entering a position.

Looking only at this drawing, the buying and selling places are not that bad, right?

But when you add the big picture above, the overall conditions don’t look that rosy anymore.

opening

- Underlying: DDOG

- Date: 12 Jan 2024

- Underlying Price: 122.37

- Stop Loss: 115.53

- Profit Target: 146.84

- Market Outlook: Confirmed uptrend

- RS Rating: 95

- Position Risk, %: 5.54

- Position Risk to NL, %: 0.31

- Potential Profit (Position), %: 19.84

- Risk to Reward Ratio: 0.28

- Position Size, %: 5.62

- Reason for Opening Trade: The price was only 1.9% above EMA 21. Classified as a CAN SLIM stock.

- Ideal Buy Assessment?: No, the volume wasn’t high enough when the price broke out of the base.

closing

- Follow-up Date: 25 Jan 2024

- Price (Close): 119.89

- Market Outlook (Follow-up): Confirmed uptrend

- RS Rating (Follow-up): 94

- RS Change: -1

- Remarks: Third down day in a row with heavy volume.

results

- What Went Well: The position was liquidated according to plan.

- Cause of Error/Improvement: The stock was too volatile, and the stock’s base was too deep. The handle area of the cup had declined too sharply and was at the lower area of the cup.

- Lessons Learned:

- 1. Buy stocks that have tight price action (daily and also not deep base).

- 2. The handle has to be at the top third part of the cup and have low volatility.

- Position ROI, %: -3.63

- Position ROI (Portfolio), %: -0.20

- Position Open Time (Trading Days): 8

- Position Open Time (Days): 13

- When you compare the details with my other trades, you can see that the main metrics, like risk/reward ratio, position sizes, and position risks, are quite the same.

In Conclusion

Embarking on the journey of stock trading with these strategies in mind is like setting sail with a map and compass in hand. Tight price action and the cup and handle pattern are not just techniques but guiding principles that can help navigate the tumultuous seas of the stock market. Remember, the essence of successful trading lies not in the avoidance of risks but in the intelligent management of them. With discipline, precision, and a keen eye for patterns, the path from novice to seasoned trader becomes a voyage of discovery and growth.

The main lesson for me is that I need to avoid picking stocks where the prices fluctuate too much. Trading and investing for me is getting better one step at a time. My job is to suck less at trading with each passing day. Happy trading, and may your investments flourish.