introduction

Navigating the unpredictable world of stock trading and the systematic approach of engineering might seem worlds apart at first glance. Yet, they share a common thread that weaves through the fabric of success: discipline. Let’s embark on a tale that underscores the pivotal role of discipline, not just in financial endeavors, but in life’s myriad challenges.

The Prelude: Setting the Stage

Before diving into the nitty-gritty of my stock trading saga, let’s establish why discipline is the cornerstone of success. In both engineering and trading, the allure of quick wins or cutting corners can be tempting. However, the steadfast adherence to a well-thought-out plan distinguishes the triumphant from the transient.

Opening Moves: The Strategy

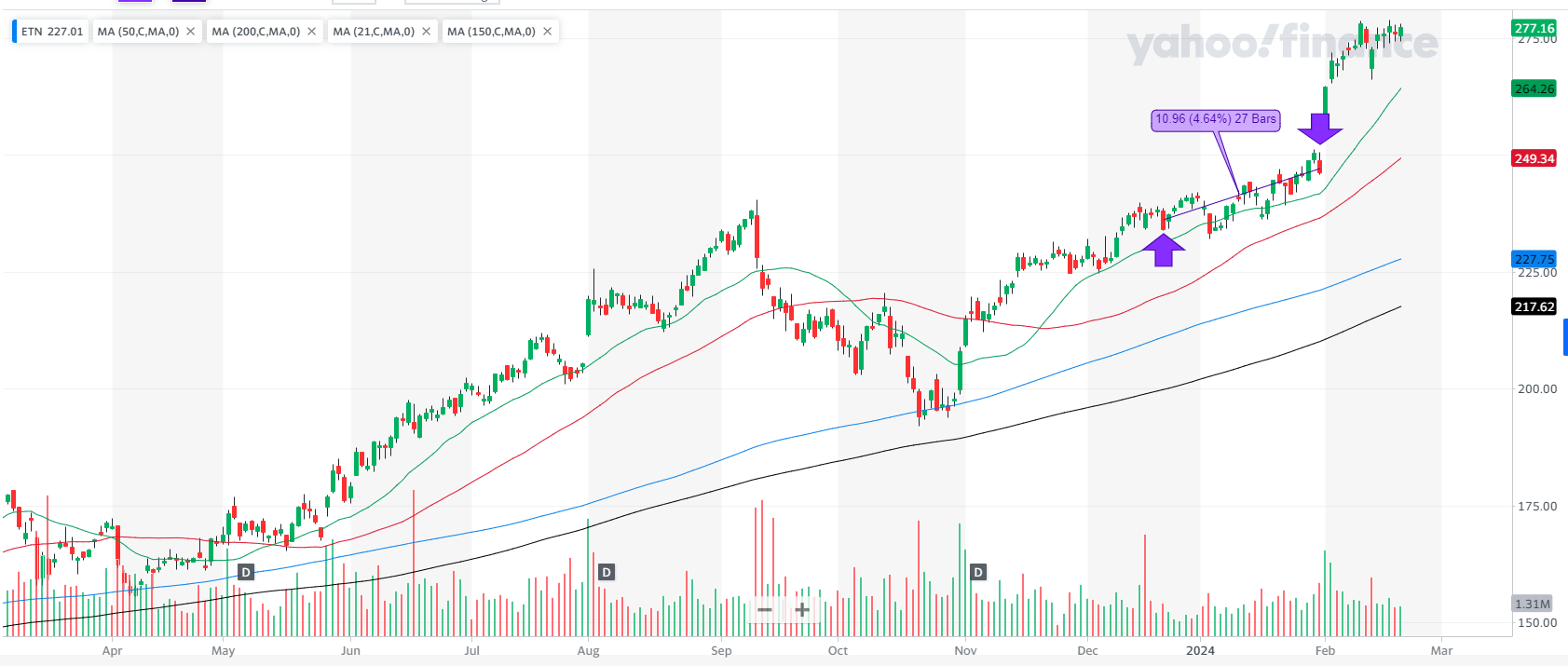

- Underlying Asset: My foray began with ETN, a beacon of potential in a sea of stocks, on the 20th of December, 2023.

- Initial Position: Taking a stand at $237.98, with a blend of anticipation and strategy.

- The Blueprint: A stop loss at $223.41 and a profit target at $283.40 served as my navigational aids, ensuring I never lost sight of my risk and reward.

The discipline here was in the preparation. Despite the allure of a promising breakout, the lack of volume signaled caution. It was a clear demonstration of discipline over impulse, a lesson in not chasing after every opportunity that glitters, possibly gold or not.

Mid-Game Adjustments: The Evaluation

As the days unfolded, the importance of adaptability within the framework of discipline became apparent. The market, much like a complex programming project, required constant monitoring and a readiness to pivot as needed, all while staying true to the overarching strategy.

The Closing Chapter: Decision Time

- Farewell to ETN: On the 31st of January, 2024, I closed my position at $246.70, amidst an uptrend and an improved RS Rating.

- Strategic Exit: The decision to sell was not driven by fear or greed but by a disciplined assessment of the risk ahead of earnings.

This part of the journey underscored the virtue of discipline in decision-making. The market rewarded my caution, and although I missed a subsequent surge, the disciplined approach validated itself by avoiding potential losses.

The Debrief: Reflections and Revelations

- Successes and Setbacks: The exit strategy and the initial choice to engage based on strategy, not emotion, were key wins. Yet, recognizing the missed opportunity to have ETN on my radar earlier reminded me of the importance of vigilance and preparation.

- Wisdom Gained: The journey echoed the wisdom of trading sages and paralleled fundamental principles—success lies in the execution of a plan, not in the erratic swings of fortune.

The Discipline Doctrine: A Closer Look

Here, we delve deeper into why discipline is the bedrock of enduring success. It’s about making informed decisions, sticking to your plan amidst the tempest of market volatility, and methodically analyzing outcomes for continuous improvement.

Long-Term Vision: Discipline as the Pathway to Success

Discipline transcends the immediate highs and lows, focusing on the bigger picture. It’s what enables us to persevere through setbacks and celebrate the wins without losing sight of our goals.

details at a glance

Opening

- Underlying: ETN

- Date of Opening: 20 Dec 2023

- Underlying Price at Opening: $237.98

- Stop Loss: $223.41

- Profit Target: $283.40

- Market Outlook at Opening: Confirmed uptrend

- Relative Strength (RS) Rating at Opening: 88

- Position Risk (%): 6.10%

- Position Risk to New Low (%): 0.65%

- Potential Profit for Position (%): 19.01%

- Risk to Reward Ratio: 0.32

- Position Size (% of Portfolio): 10.66%

- Reason for Opening the Trade: Strong stock breaking out of a base in an uptrend and tight trading. The decision was influenced by the CAN SLIM strategy and observing the stock’s EMA 21.

- Evaluation of the Buy as Ideal: No, it was not considered ideal because the volume wasn’t high enough at the time of purchase.

Closing

- Date of Closing: 31 Jan 2024

- Closing Price: $246.70

- Market Outlook at Closing: Confirmed uptrend

- RS Rating at Closing: 89

- RS Change: Increased by 1 point

- Remarks on Closing: Sold due to earnings being one day away and the profit cushion being less than 5%. The reaction to the earnings release was positive, but the decision to sell was made to avoid the risk associated with holding through the earnings announcement despite missing out on potential gains.

- Evaluation of Decision to Sell: Decisive action was taken to sell, which was seen as correct despite missing the gains from the earnings surge. The rationale was based on not having a sufficient profit cushion to justify the risk.

Results

- What Went Well: Decisive selling and initial purchase based on a breakout strategy.

- Cause of Error / Improve: The stock should have been on the active radar a year earlier when it was breaking out of its first-stage base.

- Lessons Learned: Echoing the sentiments of traders Ross Cameron and Mark Minervini, success is attributed to acting according to the plan rather than the outcome of winning or losing. The implementation of the CAN SLIM strategy is recognized as more challenging and complex in practice than it appears in theory.

- Position Return on Investment (ROI) (%): 2.81%

- Position ROI as a Percentage of Portfolio: 0.30%

- Position Open Time (trading days): 27 days

- Position Open Time (days): 42 days

The Final Word: Embracing Discipline in All Endeavors

The narrative of my trading experience with ETN, while specific in its details, carries a universal message: discipline is paramount. Whether facing the intricacies of engineering problems or the ebbs and flows of the stock market, a disciplined approach provides clarity, stability, and direction.

Remember, discipline isn’t about restriction; it’s about empowerment. It frees us from the shackles of short-term setbacks and guides us toward long-term achievements. So, as we navigate the complexities of our careers and personal endeavors, let’s champion discipline as the #1 mindset for success.