I. Setting the Stage: My Vertex Pharmaceuticals Journey

Embarking on the thrilling journey with Vertex Pharmaceuticals Incorporated (VRTX) from March 2 to April 25, 2022, was a personal adventure filled with excitement and challenges. As I delved into the dynamics of the market, the stock had already broken out of the base four months earlier, signaling a strong uptrend that set the stage for a captivating trade.

II. Before Taking the Plunge: My Analysis

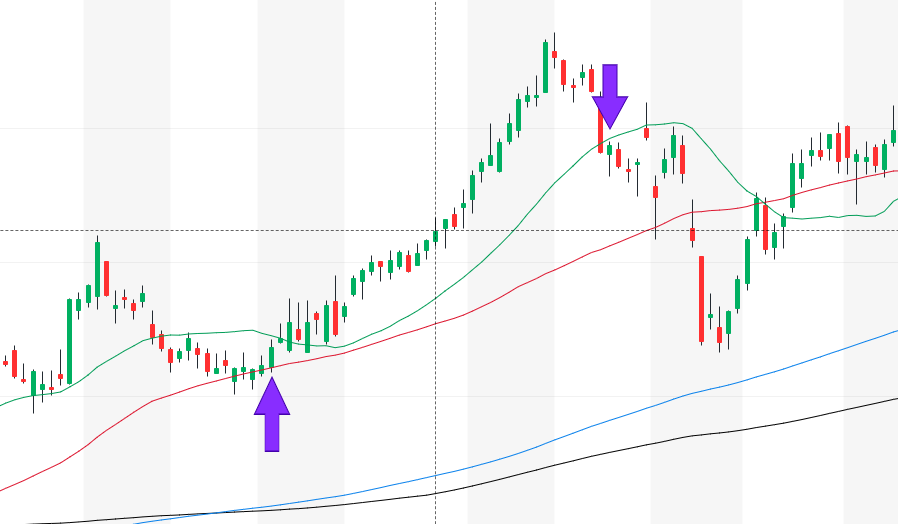

In the moments leading up to the trade, I found myself immersed in a deep analysis of the stock’s behavior. The bounce from SMA 50 was not just a technical indicator but a pulse, a heartbeat resonating with potential. Although the volume wasn’t roaring, there was a subtle clarity that the price had an undeniable tendency to move upwards. The decision to take the plunge was a mix of data, intuition, and a gut feeling that something extraordinary was about to unfold.

This stage of analysis, where every chart and trend spoke a language only a trader could understand, made me appreciate the artistry of the stock market. It wasn’t just about numbers; it was about decoding the narrative written in candlestick patterns and moving averages.

III. The Big Leap: Executing the Trade

March 2 marked the day of the big leap. Buying one stock at the price of 234.95 was not just a transaction; it was a commitment to the journey. The excitement was palpable as the stock’s price immediately responded by continuing its upward trajectory, validating the anticipation that fueled the decision.

The click of the “buy” button echoed the beginning of a story, each price movement narrating a chapter in the evolving tale of the market. It was not just about owning a stock; it was about becoming part of its narrative, understanding its nuances, and predicting its twists and turns.

IV. Climbing the Peak and Navigating the Fall

April 13 brought the peak of the adventure. As the stock reached its zenith, there was a mix of exhilaration and anticipation of what lay ahead. The subsequent descent was not without its challenges—volatile days, unexpected twists, and a few closes that left me questioning the path. Navigating these fluctuations became a test of resilience and strategic thinking.

The peak was the moment of glory, the pinnacle of success that every trader aspires to reach. However, it was the fall that revealed the true mettle of the trade. Every downward tick on the chart was a lesson in adaptation, a chance to refine strategies, and a reminder that the market is a dynamic force that requires constant attention and adjustment.

V. Closing the Chapter: My Exit Strategy

The decision to close the position on April 25, as the stock closed below EMA 21 at 267.98, marked the end of a chapter. The satisfaction of a profit of 31.04 dollars, a 13.15% gain (commissions included), after 23 intense days, added a sweet taste to the journey.

The exit was not just a financial decision; it was a farewell to a companion that had been a significant part of daily routines. It was about recognizing that every journey, no matter how exhilarating, has its destination. The closing of the chapter was a testament to discipline and the ability to make tough decisions when the narrative of the trade took an unexpected turn.

VI. Celebrating Wins: Many Things Went Well

As the price continued to decline, the captured profit became a personal victory. Amidst the unpredictable market, certain aspects of the trade went exceptionally well. The joy of success was not just in the financial gain but in the strategic moves that unfolded.

Celebrating wins in trading is a personal affair, a dance of triumph that happens behind the screen. It’s the acknowledgment of the well-timed entries, the precise exits, and the ability to ride the wave of uncertainty. Success in trading is not just about numbers; it’s about the personal growth and confidence gained in the process.

VII. Wrestling with Lack of Control Over Price Action

The realization that the market’s whims are beyond my control brought both a sense of humility and introspection. The journey of measuring successes and failures shifted towards analyzing factors within my control, acknowledging the unpredictable nature of the market.

Wrestling with the lack of control over price action is an ongoing battle, a dance between embracing the uncertainty and striving for a semblance of order. It’s a reminder that, in the vast sea of market forces, I am but a sailor navigating the waves with the tools and knowledge at my disposal.

VIII. The Personal Journey of Improvement

Reflecting on the near-perfect execution of the trade, the personal journey of improvement became a focal point. The question lingered: could the trade have been even more flawless? A commitment to continuous growth and learning emerged from this reflection.

Improvement in trading is not just about refining technical skills; it’s about evolving as an individual. It’s about understanding one’s own psychological triggers, biases, and emotional responses to market movements. The personal journey of improvement is a commitment to becoming a better version of oneself, both as a trader and as an individual navigating the complexities of the financial world.

IX. Heartache of Missed Opportunities

The personal heartache of witnessing the current stock price surpassing $400 brought a mix of emotions. The missed opportunities became a source of motivation, urging a deeper understanding of market dynamics and the importance of proactive decision-making.

Missed opportunities are the bittersweet symphony of trading. They are the echoes of what could have been, the haunting melodies that linger in the mind. However, they are also the catalysts for growth, prompting a reassessment of strategies, a deeper dive into market analysis, and a commitment to seizing opportunities in the future.

X. The Personal Speculative Saga

Trading, in its essence, is a personal speculative saga. Channeling the wisdom of William O’Neil, I found resonance in the idea that all stocks are speculative. Acknowledging this reality transformed my perspective, making each trade a personal journey of speculation, learning, and adaptation.

The personal speculative saga is an acknowledgment that, in the world of trading, certainty is a rare commodity. It’s about embracing the unknown, navigating the unpredictable, and finding a certain thrill in the speculative nature of financial markets. Each trade becomes a personal story, a narrative that unfolds with every tick of the market.

XI. The Personal Lesson: Keeping Watchful Eyes

The key takeaway from VRTX and other advancing securities became a personal lesson in vigilance. The commitment to keeping an intimate eye on trades and buying back when the personal timing aligns emerged as a guiding principle for future endeavors. In the ever-evolving landscape of the market, the personal touch and intuition play a crucial role in navigating the uncertainties and seizing the right moments.

Keeping watchful eyes is not just about monitoring price movements; it’s about staying attuned to the subtle shifts in market sentiment, understanding the narrative that unfolds in real-time, and being proactive in response. It’s a personal commitment to staying engaged, staying informed, and staying ready to act when the time is right.

In conclusion, my journey with Vertex Pharmaceuticals was not just a sequence of trades; it was a personal odyssey. Each rise and fall, every win and missed opportunity, contributed to the tapestry of my growth as a trader. The market, with its unpredictability, served as a canvas where I painted my strategies, emotions, and lessons learned.