In the realm of stock trading and life, small errors and lapses in judgment can be our undoing, much like mistaking salt for sugar in your morning coffee. It’s these little mistakes that often prevent us from capitalizing on profits, cutting our losses short, or grabbing opportunities by the horns. But fear not, for I’ve ventured through the mist and emerged with a time management method that’s as revolutionary as putting wheels on luggage.

Prelude: Embarking on the BHVN Adventure

One fine morning in January 2024, filled with the kind of optimism that can only be fueled by a fresh cup of coffee, I set my sights on BHVN.

The Initial Leap

- Underlying: BHVN

- Date Opened: 31 Jan 2024

- Price at Open: $45.03

- Rationale: It was alluring, showing signs of an uptrend, much like the siren call of the open sea.

However, was it the perfect storm I was looking for? Alas, no. My eagerness led me astray from the fact that it wasn’t yet in the buy zone.

The Unraveling: Saying Farewell to BHVN

As quickly as it began, my tryst with BHVN came to an end. I decided to sell because the price fell below EMA 21.

The Swift Exit

- Date Closed: 2 Feb 2024

- Closing Price: $43.28

- Epilogue: The stock dipped below EMA 21, prompting an abrupt but necessary goodbye.

This was a brief encounter, ending not with fireworks, but a lesson learned.

Reflections: Comedy and Tragedy

Now, let us delve into the heart of the matter, where the lessons are as rich as a well-aged wine.

Triumphs and Tribulations

- Victories: My swift action in selling above the stop-loss was a small but noteworthy win.

- Pitfalls: The familiar foe of forgetting to set an alarm reared its ugly head once more, akin to missing a crucial turn on a journey.

The Hard-Earned Insight

This recurring oversight led to a moment of clarity. It wasn’t just about setting rules; it was about creating a system to ensure those rules were followed.

Crafting the Time Management Masterpiece

It dawned on me that effective time management and habit formation weren’t about stringent schedules but about intelligent reminders.

Identifying the Culprits

- Habitual Mistakes: These weren’t just to be eradicated; they needed to be acknowledged first. We all have problems and errors that we aren’t even aware of. Some of them are the obstacles on our way.

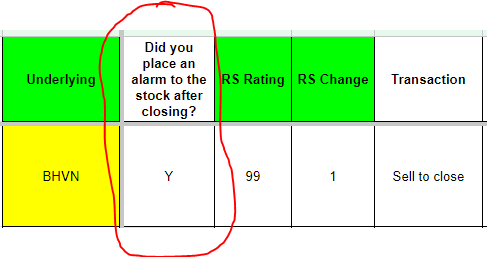

- What I did was add just this column to my trading table:

The Ingenious Solution

- Time Management Revolution: A reminder system so simple yet so profound, it was like discovering fire.

The Broader Perspective

In the intricate dance of life and trading, it’s the subtle steps that make the performance memorable. We’re all prone to missteps, but it’s our response that shapes our path.

Embracing the Lessons

This journey taught me more than just the nuances of trading; it was a masterclass in self-improvement.

The Ultimate Takeaway

While BHVN didn’t lead me to a treasure chest, the wisdom it imparted was worth its weight in gold.

- Position ROI, %: -5.33%. A number that didn’t tell the whole story.

- A Revelation in Time Management: The true treasure was in learning from my mistakes and setting a course to not repeat them.

details at a glance

Opening

- Underlying: BHVN

- Date Opened: 31 Jan 2024

- Underlying Price at Open: $45.03

- Stop Loss: $42.33

- Profit Target: $54.04

- Market Outlook at Open: Confirmed uptrend

- RS Rating at Open: 98

- Position Risk, %: 5.96%

- Position Risk to NL, %: 0.37%

- Potential Profit (Position), %: 19.85%

- Risk to Reward Ratio: 0.30

- Position Size, %: 6.16%

- Reason for Opening the Trade: Price was near EMA 21 and trending up, leading industry.

- Was it an Ideal Buy?: No. The stock was not in the buy zone.

Closing

- Date Closed: 2 Feb 2024

- Closing Price: $43.28

- Market Outlook at Close: Confirmed uptrend

- RS Rating at Close: 99

- RS Change: 1

- Reason for Selling: Closed because the price fell below EMA 21.

Results

- What Went Well: Sold decisively above the stop-loss area. Took a very small position because it wasn’t a CAN SLIM stock.

- Cause of Error/Improvement: Again, the same mistake. I wasn’t using an alarm. This means that I haven’t learned yet.

- Lessons Learned: Time Management solution: I placed a reminder on my selling list to set an alarm for the stock price after selling. When doing daily stock trades, there is a lot to remember and note. It’s sometimes easy to miss your own rules, but that’s not okay.

- Position ROI, %: -5.33%

- Position ROI (Portfolio), %: -0.33%

- Position Open Time (Trading Days): 2

- Position Open Time (Days): 2

Epilogue: A Trader’s Renaissance

In wrapping up this tale, it’s clear that the essence of trading, and indeed life, isn’t in avoiding mistakes but in evolving from them. With my newfound time management strategy, I’m not just navigating the stock market; I’m charting a course toward a better version of myself.

The Path Forward

Armed with discipline and a dash of humility, I step back into the fray, ready for whatever the market throws my way. After all, with a little more wisdom and a lot less repetition, who’s to say what heights I can reach?

In the end, it’s not about the falls we take but the grace with which we rise. Here’s to turning bad habits into stepping stones for success, one reminder at a time.