Navigating the investment highway can be thrilling yet unpredictable. Just as we buckle up when driving, it’s crucial to secure our financial journey. Let’s take a look at why an investment seatbelt is not just an accessory but a necessity.

The Starting Line: Choosing the Right Vehicle

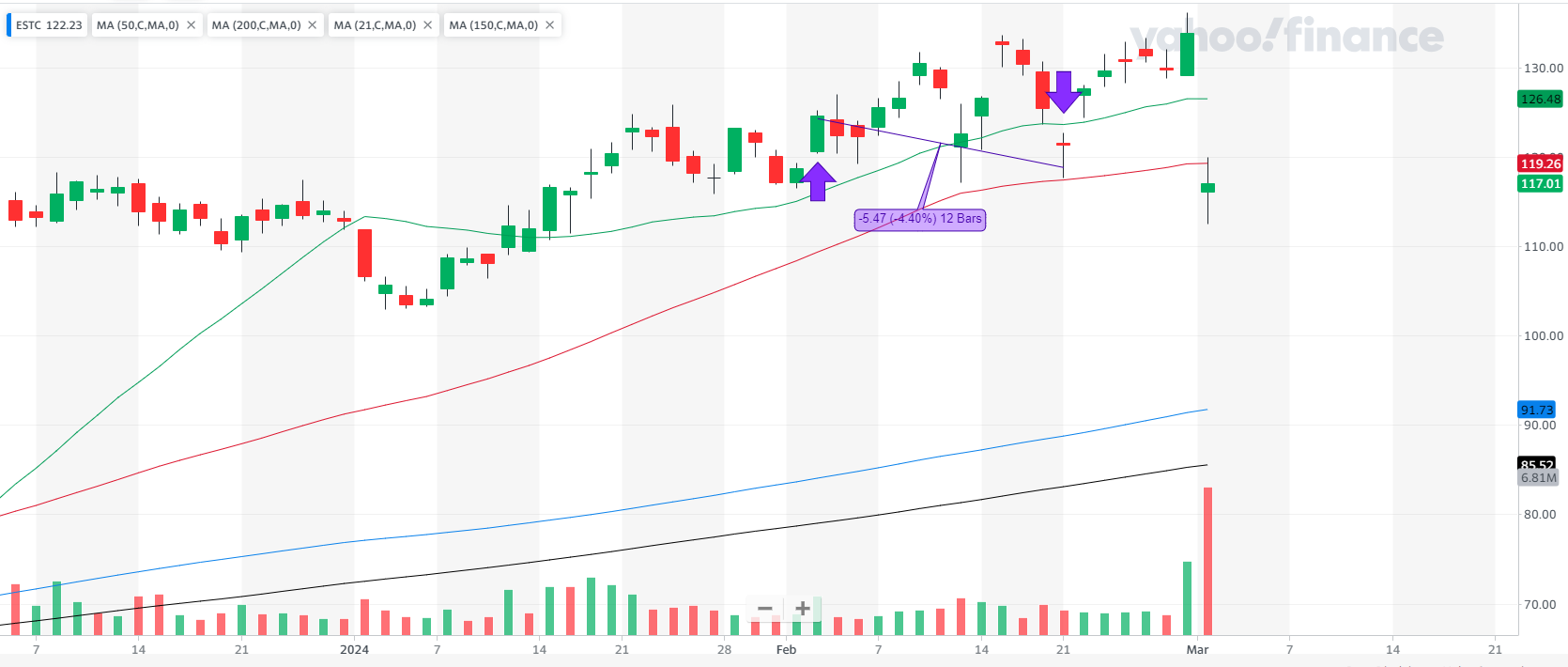

On a chilly morning in February 2024, I spotted ESTC, a stock that seemed to rev its engines, ready to zoom off the starting line. It was like finding a Lambo with a shiny price tag of $123.87, promising an exhilarating ride.

- The market’s green flag was waving with a confirmed uptrend.

- With a performance rating hitting 98, this stock was not just participating; it was aiming for a podium finish.

Yet, despite the roar of its engine (the trading volume) and its pole position in the industry, something held me back from flooring the accelerator.

Navigating the Track: Strategy on the Road

Investing without a map is like driving blindfolded. I had my route planned:

- The buy zone was my designated lane, but I noticed ESTC was hugging the outer edge.

- The trading volume was my traffic report; it was decent, but I hoped for fewer roadblocks (higher volume).

This journey wasn’t just about speed; it was about smart navigation.

Unexpected Detours: The Market’s Mood Swings

By February 21, the scenery changed. My dashboard (the market outlook) still showed clear skies, but my vehicle (ESTC) started to sputter:

- A slight dip in the RS rating was like a warning light flickering on the dashboard.

- My investment’s ABS (the stop-loss strategy) was activated, preventing a potential spinout.

Pit Stop Review: Analyzing the Pitfalls

After exiting the highway, it was time to review the dashcam footage:

- The thrill of the chase was palpable when the stock surged, akin to overtaking on a fast straight.

- Yet, the volatility was a reminder of the road’s unpredictability, where a smooth lane can suddenly turn twisty.

The race ended with a modest loss, a small bump in my journey, emphasizing the value of readiness for abrupt stops.

Safety Features: Essential Investment Protections

Just as cars come equipped with airbags and seatbelts, investors need protective measures:

- Stop-loss orders are our airbags, deploying to cushion us during a crash.

- Diversification is like having all-wheel drive, ensuring stability across various terrains.

The Finish Line: Secure and Steady Wins the Race

In the investment race, speed can be thrilling, but safety ensures longevity. Stocks like ESTC, which gap up, might tempt us to hit the gas, but without a seatbelt, the risk of a crash escalates.

- My brief journey with ESTC, spanning 19 days, was a testament to the market’s fickle nature.

- A -4.52% ROI was a small price for a valuable lesson: the importance of being strapped in.

details at a glance

Opening

- Underlying: ESTC

- Date: 2 Feb 2024

- Underlying Price: 123.87

- Stop Loss: 115.28

- Profit Target: 148.64

- Market Outlook: Confirmed uptrend

- RS Rating: 98

- RS line trend: Up

- Industry Rank: 26 out of 197

- Volume U/D Ratio: 1.8

- Position risk: 6.88%

- Position Risk to NL: 0.39%

- Potential Profit (position): 19.84%

- Risk to Reward Ratio: 0.35

- Position size: 5.70%

- Reason for opening the trade: Price was in the buy zone, RS line was trending up. Not a CAN SLIM stock due to lack of earnings and sales growth. The stock was under accumulation with a U/D ratio of 1.8 and had a strong industry rank of 26 out of 197.

- Was it an ideal buy: No. Didn’t buy at the breakout. The stock price was at the top of the buy zone and volume wasn’t very high at the breakout.

- Remarks: I took a small position and could not increase the position due to relatively high P/E.

Closing

- Closing Date: 21 Feb 2024

- Closing Price: 120.23

- Market Outlook at close: Confirmed uptrend

- RS Rating at close: 97

- RS Change: -1

- Closing Remarks: Portfolio stop-loss was triggered due to a loss, prompting the closure of the position.

Results

- What went well: Took a small position as the price had more than doubled from the recent low of the base. Tried a strategy of buying a stock that had gapped up on high value.

- Cause of Error/IMPROVE: Everyday volatility was high, making it harder to manage.

- Position ROI: -4.52%

- Position ROI (portfolio): -0.26%

- Position Open Time (trading days): 12

- Position Open Time (days): 19

Final Thoughts: The Road Ahead

As we cruise through the investment landscape, let’s remember that the goal isn’t just to reach our destination swiftly but to enjoy the journey safely. Whether it’s a smooth highway or a bumpy trail, our financial seatbelt ensures we navigate with confidence, ready to face the market’s twists and turns.

So, the next time you spot a potential investment speeding ahead, ask yourself: “Is my seatbelt fastened?” Because in the world of investing, safety isn’t just a precaution; it’s a strategy.