In the world of stock trading, having a robust stop-loss strategy is like having a reliable safety mechanism in place – it’s essential for protecting your investments during market downturns. Let’s delve deeper into the art of setting effective stop-losses, especially when dealing with the unpredictability of volatile stocks.

Laying the Groundwork: Strategic Planning

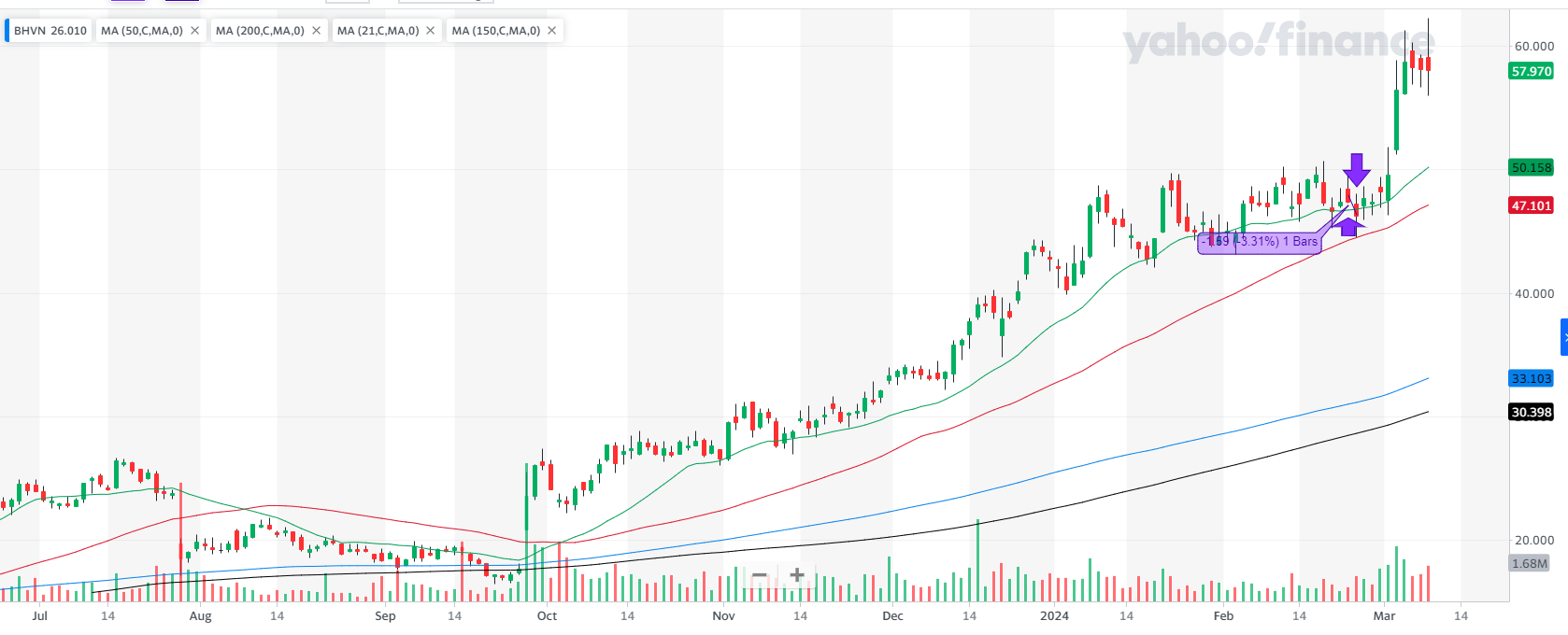

Before diving into the market’s depths, I laid out a meticulous plan with BHVN as my focal point:

- Choosing the Right Candidate: BHVN stood out with its promising uptrend and strong industry rank, signaling potential growth and stability.

- Setting the Destination: My entry at $48.32, targeting a $57.98 profit, was not arbitrary. It was a calculated decision aimed at maximizing potential returns while minimizing risks.

Establishing Your Safety Net: The Stop-Loss Necessity

- Positioning the Safety Net: My stop-loss at $45.97 was strategically placed. It wasn’t too close to the entry point to avoid being triggered by minor fluctuations, nor too distant to expose me to substantial losses.

The Market’s Test: Encountering Volatility

The true test of any strategy comes when it faces the market’s inherent volatility:

- Responding to Market Shifts: The dip to $45.73 was a clear indicator to exit, demonstrating the stop-loss’s role in cutting losses before they escalate. You will never know how deep the dip will be.

Analyzing the Outcome: Lessons Learned

Post-trade analysis is crucial for refining strategies and preparing for future engagements:

- Evaluating the Results: Ending the trade with a -7.24% ROI was a valuable lesson in risk management and the importance of having a stop-loss in place.

- Impact on the Portfolio: The negligible impact on my overall portfolio highlighted the importance of position sizing and not overcommitting to a single trade.

Post-trade analysis is the most useful tool I have found since I started trading stocks.

Enhancing Your Approach: Adaptive Strategies

Adapting and refining your strategy is key to long-term success:

- Balanced Stop-Loss Approach: While not utilized in this scenario, employing a tiered stop-loss strategy can provide a balanced approach, offering a buffer against volatility while allowing room for growth. The case for stop-losses is that they need to be placed in a way that the potential loss is smaller than the expected profit.

- The profit potential needs to be realistic. It doesn’t happen too often that the stocks shoot to the moon (although, we all are looking for that). According to my readings and experience, I have used 1/3 to 1/2 risk-reward ratio.

Gearing Up for Future Trades: Strategic Adjustments

With each trade, the opportunity to learn and improve presents itself:

- Learning from Experience: The insights gained from this trade are instrumental in shaping more nuanced and effective strategies moving forward. The main thing here is to pay attention to the details.

- Strategic Revisions: Continuously revising and testing different stop-loss strategies can help identify the most effective approach for various market conditions.

- William O’Neil has mentioned in his book that placing a 5% stop-loss to half of a position and a 10% stop-loss to another half is sound advice. That way the average stop-loss would be at 7.5%. When trading more volatile securities, this would probably work out well.

- Probably, placing a stop-loss further away than 10% from the buying price is not a good idea because digging out of a 10% hole could be challenging.

experience from the past

In 2021, I tried a similar strategy to CAN SLIM but I placed the stop-losses and profit targets way further from the buying price. Stop-loss was 15% away and the profit target was 300% away in another direction.

This would be a 1/20 risk-to-reward ratio which sounds like a dream, right? This would mean that for every 19 trades that end with a loss one profitable trade would compensate all of these.

Well, there’s a catch. Most of the stocks could easily be 15% or even further. But finding a stock that makes a 300% return from the point you buy it is like hoping to win a lottery.

My experience showed that it didn’t work out. It was quite painful. Digging out of several 15% losses was also a misery.

That’s why I decided to tighten my stop-losses. Even though, this means getting stopped out more often than before.

details at a glance

Opening

- Underlying: BHVN

- Date (Open): 23 Feb 2024

- Underlying Price (Open): $48.32

- Stop Loss: $45.97

- Profit Target: $57.98

- Market Outlook (Open): Confirmed uptrend

- RS Rating (Open): 99

- RS Line Trend: Up

- Industry Rank: 4 out of 197

- Volume U/D Ratio: 1.4

- Position Risk: 4.82%

- Position Risk to NL: 0.22%

- Potential Profit (Position): 19.80%

- Risk to Reward Ratio: 0.24

- Position Size: 4.56%

- Reason for Opening Trade: Re-entered because the stock recovered and showed signs of accumulation. It’s a SEPA stock, and a smaller position was taken.

- Was it an Ideal Buy?: No. The price was not coming out of the base.

- Remarks on Entry: Placed a stop loss below the recent low and under EMA 21.

Closing

- Date (Close): 26 Feb 2024

- Price (Close): $45.73

- Market Outlook (Close): Confirmed uptrend

- RS Rating (Close): 98

- RS Change: -1

- Exit Remarks: Experienced volatile price action and got stopped out. The RS line appears to be dipping.

Results

- Position ROI, %: -7.24%

- Position ROI (Portfolio), %: -0.33%

- Position Open Time (Trading Days): 1

- Position Open Time (Days): 3

In Conclusion: Fortifying Your Trading Arsenal

Your stop-loss strategy is a critical component of your trading arsenal, providing a safeguard against unpredictable market movements. It’s about finding that sweet spot where your investments are protected without stifling their potential to grow. As you progress in your trading journey, let each trade refine your approach, and may your refined stop-loss strategies lead to more secure and profitable trading experiences. Here’s to making informed, strategic decisions that enhance your trading success!