Rules are like a compass that give you direction. This means that you won’t get lost that easily. How to apply the rules? How to create them?

In the bustling bazaar of buy low and sell high, the clamor for a roadmap might seem overrated. But here’s a thought: What if I told you that embracing a meticulous rulebook could turn you into the maestro of the marketplace? Let’s unwrap this enigma together, armed with nothing but wit and a keen sense of adventure.

The Opening Gambit

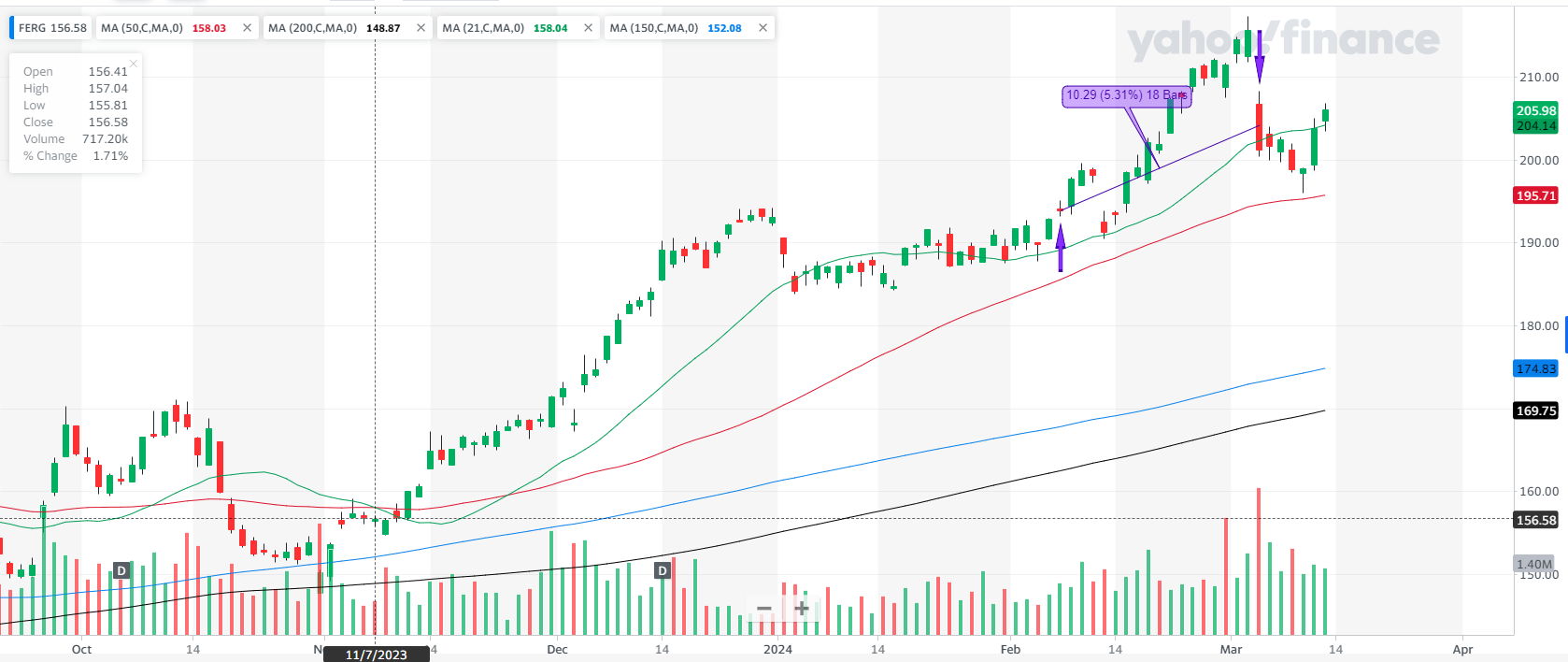

Imagine stepping into a grand theater, the spotlight hits, and it’s just you and the vast, expectant audience of potential trades. On the 7th of February, 2024, I found my spotlight with FERG. Here’s how I set the stage:

- Date Opened: 7 Feb 2024. A date etched in my planner, not in stone, but with a good pencil.

- Underlying Price at Opening: $194.27. Precise, because precision is the sibling of success.

- Stop Loss and Profit Target: $184.49 and $233.12, respectively. It’s like setting the boundaries of a playground. You know where the fun begins and ends.

The plot thickens with the secret ingredients:

- Market Outlook: Confirmed uptrend. Riding the wave, but with a life jacket.

- Position Size, %: 8.84%. Diversification is the name of the game, even if it sounds like a boring uncle.

The motive? A breakout from the base, as thrilling as catching a wave right before it crests. Ideal buy? Hardly. The volume whispered caution, a gentle reminder that not all whispers are to be ignored.

Intermission: Reflecting on the Journey

Before we leap to the end, let’s pause and ponder. In the grand tapestry of trading, every stitch counts. My decision-making was like navigating a ship through foggy seas. You know your destination, but the path? That’s where the magic of your rules lights the way.

- Evaluation of Decision: Each choice is a brushstroke on the canvas of our strategy. Not all strokes are broad and bold; some are cautious, testing the waters before diving in.

The Grand Finale

As all good shows must end, so did my dalliance with FERG on 5th March 2024:

- Closing Price: $205.41. A modest bow as the curtains close.

- Market Outlook at Closing: Still an uptrend. The audience claps; the performance wasn’t for naught.

Why leave the stage? A significant dip, like a missed step in a dance, signaled it was time. Exit stage left, gracefully, if not a bit hurriedly.

Encore: The Aftermath and Enlightenment

The spotlight dims, the theater empties, but the lessons linger:

- Spotlight on Success: I exited at a commendable point. Like finding an umbrella just as it starts to rain.

- Room for Improvement: Perhaps entering the scene earlier at $170 would have been a stroke of genius. Alas, hindsight is the only perfect science.

And from this reflection, wisdom blooms:

- Timing is an Art: Just as catching the perfect sunset, selling a day earlier could have been splendid.

- Innovation in Rules: Like choosing the right spice for a dish, adding new criteria to avoid potential pitfalls is crucial.

And thus, we tally the gains:

- Position ROI, %: 4.68%. Not a treasure chest, but certainly not empty-handed.

- The Time It Took: 18 trading days. Sometimes, patience is the most underrated virtue.

details at a glance

Opening

- Underlying: FERG

- Date Opened: 7 Feb 2024

- Underlying Price at Opening: $194.27

- Stop Loss: $184.49

- Profit Target: $233.12

- Market Outlook at Opening: Confirmed uptrend

- RS Rating: 89

- RS Line Trend: Up

- Industry Rank: 23 / 197

- Volume U/D Ratio: 1.8

- Institutional Ownership Trend: Up

- Position Risk, %: 5.01%

- Position Risk to NL, %: 0.44%

- Potential Profit (Position), %: 19.90%

- Risk to Reward Ratio: 0.25

- Position Size, %: 8.84%

- Reason for Opening Trade: Price broke out of a base. Initiated due to CAN SLIM, albeit close to EMA 21, indicating a strategic entry point.

- Evaluation of Ideal Buy Point: No, the trade wasn’t ideal. Volume was not high enough at the time of purchase.

- Remarks at Opening: The stock was bought for speculation. EPS and sales growth were inconsistent.

Closing

- Closing Date: 5 Mar 2024

- Closing Price: $205.41

- Market Outlook at Closing: Confirmed uptrend

- RS Rating at Closing: 88

- RS Rating Change: -1

- Remarks at Closing: Sold the stock due to significant decline on a down day.

Results

- Evaluation of Selling Decision: The position was opened slightly above EMA 21, which was considered a good buying point. The sale was decisive and manual, occurring at a pivotal price of 194.13, nearly catching a breakout.

- What Went Well: Sold decisively at a good point; the stock was bought when intraday volatility was low.

- Cause of Error/Improvement: Could have bought the stock earlier around the $170 level. A reconsideration of buying stocks with slowing EPS growth is needed.

- Lessons Learned: Selling a day earlier could have resulted in approximately 10% profit. The importance of selling before a potential fall and testing new rules regarding earnings and strong fundamentals, aligned with CAN SLIM criteria, was noted.

- Position ROI, %: 4.68%

- Position ROI (Portfolio), %: 0.41%

- Position Open Time (Trading Days): 18 days

- Position Open Time (Days): 27 days

The Moral Revisited: The Symphony of Rules

Why indeed do we need trading rules? Imagine walking a tightrope blindfolded without a safety net. That’s trading without rules. The net? It’s your carefully curated set of guidelines, your lifeline across the chasm.

By weaving a detailed set of rules into the fabric of my strategy, I transformed a potential tapestry of chaos into a navigable map of stars. Did these stars guide me to treasure? Perhaps not always to X marks the spot, but they certainly steered me clear of shipwreck.

So, as you stand at the helm of your own adventure, remember: The marketplace is an ocean, vast and unpredictable. But with a compass of well-crafted rules in hand, you’re not just adrift; you’re charting a course through starlit seas. And who knows? With the right guidance, you might just find yourself not only navigating but conquering the waves, all the while dancing to the rhythm of the market’s most enigmatic tunes.