This article outlines a stock trade that hands you the keys to identifying prime buying opportunities. Trade this way, and watch your account size grow like never before.

In the intricate dance of the stock market, knowing when to step forward, when to pause, and when to gracefully exit can make all the difference between a stumble and a pirouette. With the right moves, even the most risk-averse among us can spin across the floor with confidence, turning a tidy profit without risking the family silver.

Prelude to Prosperity

Spotting the Star Performer

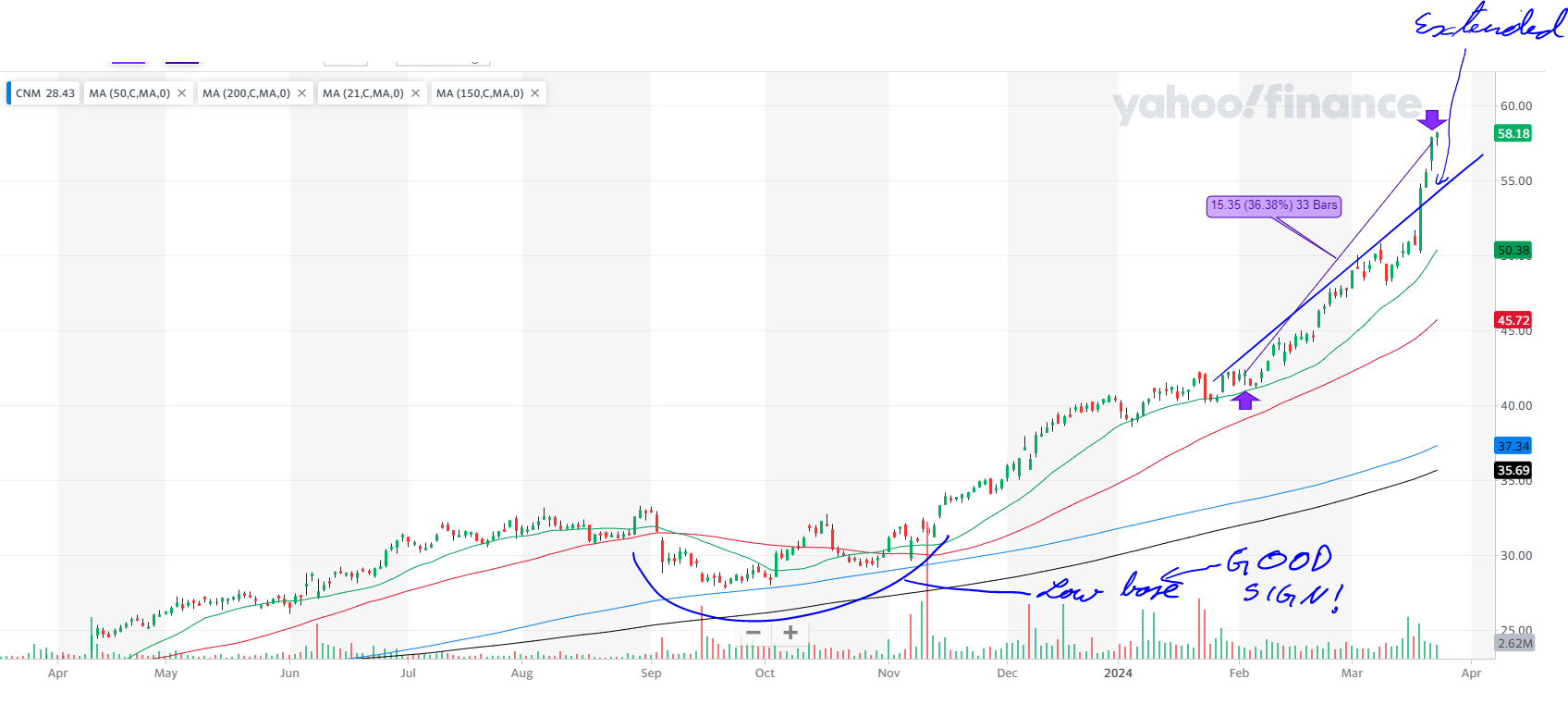

Imagine spotting a rare, vintage car in a lot full of sedans and hatchbacks. That was CNM for me on February 2, 2024. It wasn’t just any stock; it was a beacon of potential in a sea of mediocrity, priced at a mere $41.91.

Crafting the Blueprint

- The Setting: The market was blooming like a garden in spring, signaling it was time to plant seeds.

- The Hero: With a RS Rating of 95, CNM was not just participating in the race; it was leading it.

- The Support: The institutional ownership trend was upward, much like having a tailwind while flying a kite.

Embarking on the Journey

Taking the Plunge

I bought CNM with the excitement of a kid in a candy store, yet the precision of a jeweler setting a diamond. It was slightly over its ideal price, akin to paying extra for front-row concert tickets because you know the experience is worth it.

The Strategy in Play

- My stop loss was set at $39.96, a safety net discreetly tucked away.

- The profit target was ambitiously placed at $50.29, eyeing the horizon but grounded in reality.

The Turning Point

Harvest Time

By March 21, CNM had ascended to $56.25, soaring beyond my expectations. It was time to reap what I had sown, securing profits while the market’s applause was loud.

Encore! Encore!

- The thrill of victory was sweet, like savoring a perfectly aged wine.

- The strategic stop loss proved to be the guardian angel, ensuring the leap was daring but not reckless.

Unveiling the Curtain

The Bittersweet Symphony

- I had navigated the tightrope with a blend of boldness and prudence, a feat that was both exhilarating and educational.

- Reflecting on the journey, I pondered the possibility of entering the scene earlier, a thought for future acts.

The Moral of the Story

- The safety measures implemented were not just precautions but pillars of my strategy, akin to the foundation of a skyscraper.

- Entering close to the EMA 21 provided a tranquility similar to knowing you have a map in unfamiliar territory.

details at a glance

Opening

- Underlying: CNM

- Date (Entry): 2 Feb 2024

- Underlying Price: 41.91

- Stop Loss: 39.96

- Profit Target: 50.29

- Market Outlook: Confirmed uptrend

- RS Rating: 95

- RS Line Trend: Upward (U)

- Industry Rank: 18 out of 197

- Volume U/D Ratio: 1.9

- Institutional Ownership Trend: Upward (U)

- Position Risk, %: 4.61

- Position Risk to NL, %: 0.27

- Potential Profit (Position), %: 19.84

- Risk to Reward Ratio: 0.23

- Position Size, %: 5.78

- Reason for Opening Trade: The stock price was less than 3% above the EMA 21, which made it a good buying point. RS line was trending up.

- Was It an Ideal Buy?: No. The stock was not in the buy zone.

- Remarks: SEPA stock, small position. Cannot increase the position because P/E is relatively high.

Closing

- Date (Exit): 21 Mar 2024

- Price (Close): 56.25

- Market Outlook (Exit): Confirmed uptrend

- RS Rating (Exit): 97

- RS Change: +2

- Exit Remarks: Realized a profit. Left part of the position open.

Results

- What Went Well?: I had the courage to realize the profit. There was a tendency to be greedy and let the price run.

- Cause of Error/Improvement: I should have found a way to keep the stock already from the $32 level.

- Lessons Learned: There is a possibility that I need a system or a better mindset for selling while taking a profit.

- Position ROI, %: 32.37

- Position ROI (Portfolio), %: 1.87

- Position Open Time (Trading Days): 33

- Position Open Time (Days): 48