terms and definitions

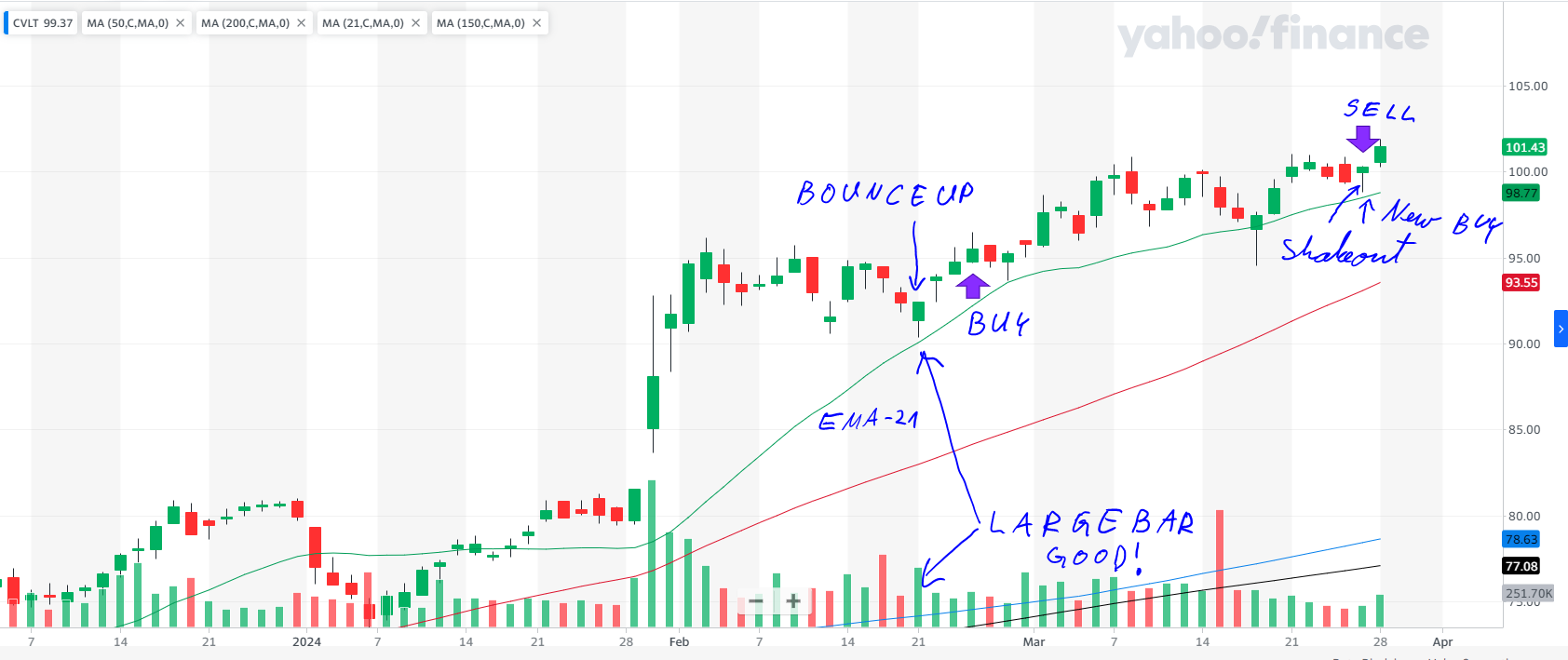

EMA 21 Calculates the 21-period exponential moving average, highlighting short-term trends.

SMA 50 Averages the price over 50 periods, showing medium-term trends without overemphasizing recent data.

SMA 200 Averages the price over 200 periods, revealing long-term trends by treating all data equally.

Industry Rank Investor’s Business Daily’s system that ranks industries 1 to 197 based on performance. It guides us in CAN SLIM TRADING towards leading sectors.

U/D Ratio Measures stocks closing up versus down. A ratio above 1.0 indicates bullish sentiment, important in CAN SLIM TRADING.

RS Rating Ranks a stock’s performance on a 1 to 99 scale. I look for at least 85, showing strong momentum and growth potential.

RS Line Compares stock price to the market, plotted as a ratio. We seek an uptrend, indicating outperformance and strong momentum.

Volatility Measures how much a security’s price fluctuates over time. High volatility means large price changes, indicating risk and potential reward.

Institutional Ownership Trend indicates whether the stock is under accumulation or distribution by the institutions.

conclusion

Navigating the tumultuous seas of the stock market requires more than just a keen eye for promising stocks; it demands resilience, a strategic mindset, and the ability to manage one’s emotions during unexpected shakeouts. Remember, getting shaken out of a position can feel like a setback, but it doesn’t have to signal defeat. Instead, it can serve as a pivotal moment for reassessment and recalibration.

Throughout this journey, we’ve explored the importance of understanding shakeouts, maintaining a cool head in their aftermath, and strategically positioning ourselves for recovery. We’ve learned from those who’ve weathered such storms before, drawing inspiration and practical advice from their experiences. Moreover, we’ve highlighted the invaluable role of tools and resources in aiding our decision-making process, empowering us to make informed, confident choices.

In conclusion, the path to investment success is rarely a straight line. It’s filled with unexpected twists and turns, shakeouts being just one of many challenges you may face. Yet, with the right approach—rooted in patience, diligence, and continuous learning—you can navigate these challenges successfully. Always remember:

- Never hesitate to buy back into a stock if your initial analysis stands and the fundamentals remain strong. Such moments might present the most straightforward opportunities for profit.

- View money, profits, and losses as numbers on a screen, tools for making decisions rather than emotional triggers.

- Leverage your knowledge and tools to stay one step ahead, making each investment decision a calculated step toward your financial goals.

Investing is as much a test of character as it is of acumen. By applying the insights and strategies shared, you’re not just preparing to face future shakeouts; you’re building a foundation for enduring success in the investment world. So, the next time you encounter a shakeout, take it in stride, armed with the knowledge that it’s yet another opportunity to refine your strategy, strengthen your resolve, and advance on your journey to investment mastery.