After reading this article, you will be equipped with the knowledge of what to look for when considering the purchase of a stock. This will give you tremendous potential for upside while minimizing risk.

Opening Strategy: A Detailed Breakdown

And it all started with a simple decision to dive into the stock market on the 2nd of February. Why this date, you might ask? It wasn’t about the stars aligning or the magic of groundhog day predictions; it was about spotting the right opportunity at the right time.

- I chose a stock with a confirmed uptrend, solid fundamentals, and a promising industry ranking. Simple, right?

- The target? A modest yet ambitious 24% total profit from two combined positions. The journey from the initial buy to the last unload stretched just shy of two months, wrapping up on the 27th of March.

Navigating Market Dynamics: From Opening to Closure

As the markets ebbed and flowed, so did my strategy. Adjusting on the fly isn’t just a fancy trick; it’s a necessity. But how did I decide when to hold ‘em and when to fold ‘em?

- I monitored the stock’s performance, keeping an eagle eye on the RS rating and market trends.

- When the stock extended beyond my comfort zone, I tightened my stop-loss. Protection first!

Analyzing the Results: What Worked and What Didn’t

Now, let’s get down to the brass tacks. Was every decision a stroke of genius?

- Riding the stock up by adjusting the stop-loss near extended price levels felt like steering a sailboat through a gentle breeze.

- But, adding to the position later than optimal? That was more like missing the bus by a minute because you had to tie your shoelaces.

Lessons Learned: Key Takeaways for Future Trades

What’s the moral of the story? Slow and steady doesn’t just win the race; it also keeps your blood pressure in check.

- Volatile stocks? More like a rollercoaster ride without the safety bar. No, thank you.

- Slow and steady price action? Now, that’s the sweet spot. This is what you and I should aim for.

Position Management and Risk Control

And here’s a little secret: managing your position is like making the perfect cup of coffee. It’s all about the right proportions.

- My position size? A cautious 4.45% of the portfolio. Not too bold, not too light.

- Risk to reward ratio? Kept it tighter than the lid on a pickle jar at 0.16.

Maximizing Returns: A Guide to Profit-Taking

The moment of truth: when to cash in on your chips. Is there a secret formula, a whispered chant, perhaps?

- It’s all about setting realistic profit targets and having an exit strategy that adapts to the market outlook. Simple and effective.

Details at a Glance

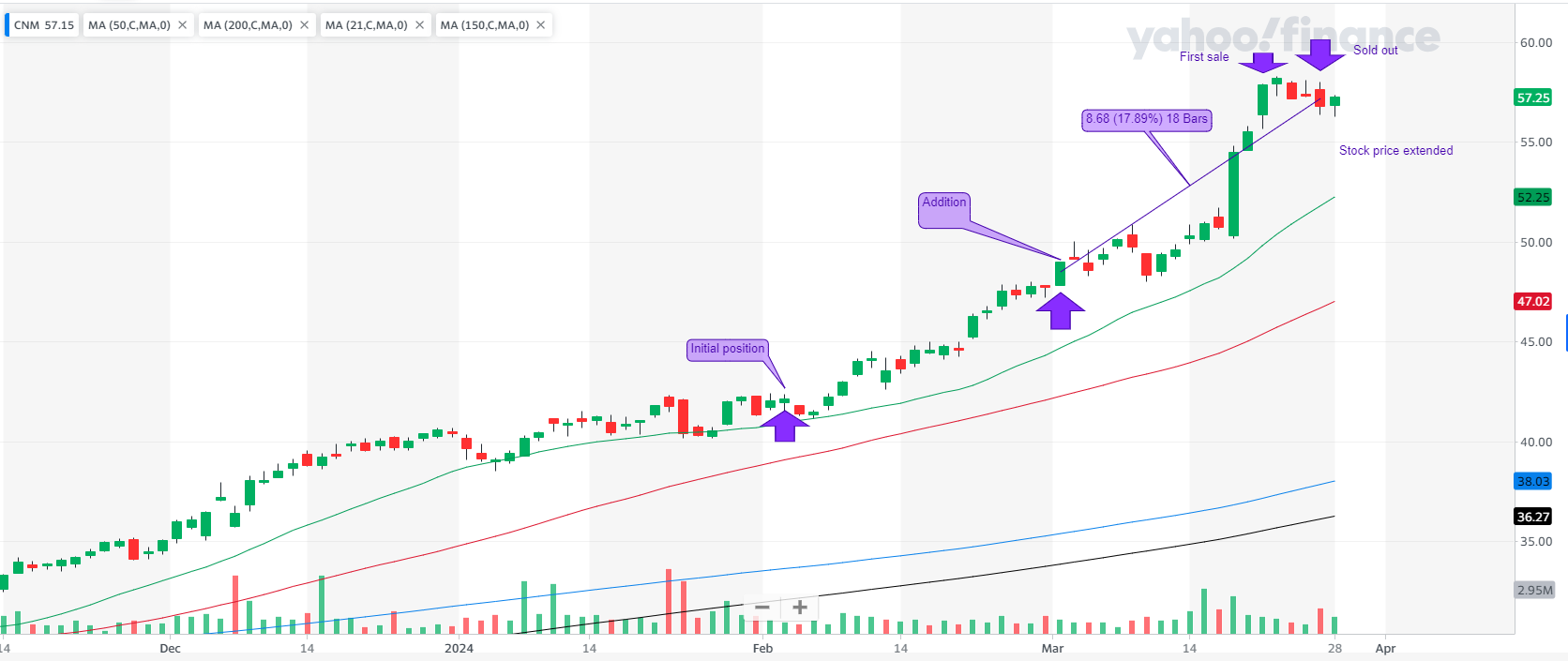

The upward purple arrows show where I bought the stock. The downward purple arrows show where I sold it. This article is about the second buy and second sell.

As you can see from the chart, I should have made the second buy a lot earlier. The profit would have been even better. Other than that, it turned out a smooth ride.

Before we wrap up, let’s bullet out the nitty-gritty:

- Total profit of 24% for two positions combined.

- The journey spanned from 2nd February to 27th March.

- Position ROI: 15.24% in 26 days. Beat that, ancient alchemists!

Opening

- Underlying: CNM

- Date of Opening: 1 Mar 2024

- Underlying Price at Opening: $48.43

- Stop Loss: $46.84

- Profit Target: $58.12

- Market Outlook at Opening: Confirmed uptrend

- Relative Strength (RS) Rating: 95

- RS Line Trend: Upward

- Industry Rank: 12 out of 197

- Volume Up/Down Ratio: 1.8

- Institutional Ownership Trend: Upward

- Position Risk: 3.25%

- Position Risk to New Low (NL): 0.14%

- Potential Profit (position): 19.80%

- Risk to Reward Ratio: 0.16

- Position Size: 4.45%

- Reason for Opening Trade: Added to the existing position due to locked-in profit.

- Ideal Buy Assessment: No, because the price wasn’t in the buy zone.

- Additional Remarks: The first part of the position was opened at the beginning of February 2024. Added to the existing position as the price action confirmed the decision.

Closing

- Closing Date: 27 Mar 2024

- Closing Price: $56.87

- Market Outlook at Closing: Confirmed uptrend

- Alarm Set Post-Close: Yes, at $58.00

- Closing RS Rating: 97

- RS Rating Change: 2

- Closing Remarks: Final profit realized after adjusting stop-loss due to extended price.

Results

- What Went Well: Managed to ride the stock up efficiently by adjusting the stop-loss near extended price levels.

- Cause of Error / Improve: Added to the position later than optimal, which could have maximized profits.

- Lessons Learned: Prefer slow and steady price action for easier management. Volatile stocks pose greater challenges.

- Position ROI: 15.24%

- Portfolio ROI: 0.68%

- Position Open Duration (Trading Days): 18 days

- Position Open Duration (Days): 26 days

Terms and Definitions

And for those moments when the jargon sounds like a foreign language, here’s a quick glossary:

EMA 21 Calculates the 21-period exponential moving average, highlighting short-term trends.

SMA 50 Averages the price over 50 periods, showing medium-term trends without overemphasizing recent data.

SMA 200 Averages the price over 200 periods, revealing long-term trends by treating all data equally.

Industry Rank Investor’s Business Daily’s system that ranks industries 1 to 197 based on performance. It guides us in CAN SLIM TRADING towards leading sectors.

U/D Ratio Measures stocks closing up versus down. A ratio above 1.0 indicates bullish sentiment, important in CAN SLIM TRADING.

RS Rating Ranks a stock’s performance on a 1 to 99 scale. I look for at least 85, showing strong momentum and growth potential.

RS Line Compares stock price to the market, plotted as a ratio. We seek an uptrend, indicating outperformance and strong momentum.

Volatility Measures how much a security’s price fluctuates over time. High volatility means large price changes, indicating risk and potential reward.

Institutional Ownership Trend indicates whether the stock is under accumulation or distribution by the institutions.

Conclusion

So, what have we learned? That the thrill of stock trading lies not in the high-octane drama of volatile markets, but in the measured, steady approach that prioritizes calculated risks and clear-headed strategies. Making a 15.24% return in 26 days might sound like a feat reserved for the Wall Street wizards, but as we’ve seen, it’s entirely within reach with the right approach. And if you’re aiming for that sweet 24% total profit in less than two months, remember: slow and steady not only wins the race but also makes the journey a whole lot smoother. Now, who’s ready to take on the stock market with a fresh perspective?