Are you aware of the mistakes you make? Do you know what they cost you? Discover through a real-life example how seemingly unimportant mistakes can cost a fortune. In this blog, we explore a small oversight in trading decisions that led to missing significant gains.

Timing in Trading

Timing isn’t just everything; it’s the only thing when it comes to trading success. But how crucial is it, really? In the upcoming sections, we’ll look at how pinpointing the perfect moment to act can make or break your financial results. And what happens when you miss that moment? The results might surprise you.

Psychological Factors and Trading Decisions

And now, let’s talk about the mind games. Why do smart people make poor choices? Often, it’s not about the lack of knowledge but how emotions play tricks on us. Fear and greed can turn a solid strategy into spaghetti. I’ll show you an example of this in action later on.

Impact of External Factors

And while we’re at it, let’s not forget the outside forces at play. Can external events really sway your trading decisions? Absolutely. Economic news, market trends, and even a tweet can send ripples through the market. We’ll explore how these factors can sometimes be more influential than your strategy.

Understanding Market Volatility

Recently, the overall market had become more volatile. Why is this significant? Because increased volatility amplifies the impact of external factors. This means that even well-planned trades can be thrown off course by sudden market changes. What does this mean for traders? It highlights the need for vigilance and adaptability.

Navigating Market Dynamics

In this volatile environment, how can traders protect their investments? The key is not just to react, but to anticipate. Understanding potential triggers and preparing for various scenarios can help traders safeguard their positions. And remember, sometimes the best reaction is a well-planned non-reaction, especially when the noise might tempt you into hasty decisions.

These insights into external factors underscore their significant influence on trading success, particularly in a volatile market. Recognizing and adapting to these influences is crucial for maintaining control over your trading outcomes.

details at a glance

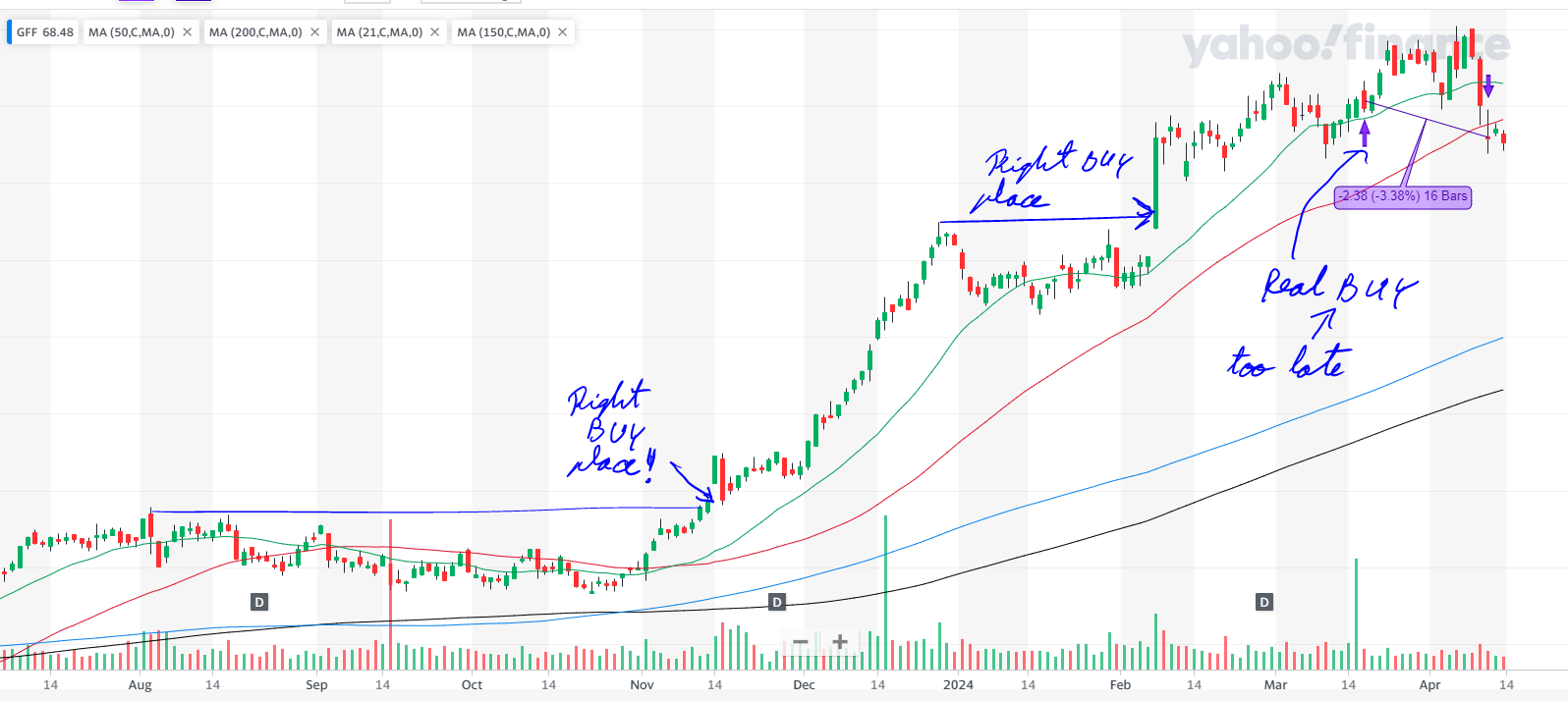

Explanations for the Drawing: The upward purple arrow shows where I bought the stock. The downward purple arrow shows where I sold it. The two places (at the left side and in the middle) point where I should have bought the stock.

Opening

- Underlying: GFF

- Date: 18 Mar 2024

- Underlying Price: $70.69

- Stop Loss: $68.41

- Profit Target: $84.83

- Market Outlook: Confirmed uptrend

- RS Rating: 96

- RS Line Trend: Upward (U)

- Industry Rank: 8 / 197

- Volume U/D Ratio: 2.2

- Institutional Ownership Trend: Upward (U)

- Position Risk, %: 3.20

- Position Risk to NL, %: 0.21

- Potential Profit (Position), %: 19.86

- Risk to Reward Ratio: 0.16

- Position Size, %: 6.50

- Reason for Trade: “Strong stock in a solid uptrend close to EMA 21. Leading industry. (e.g., CAN SLIM, EMA 21)”

- Was it an ideal buy? No. Price was not in the buy zone.

Closing

- Date: 9 Apr 2024

- Closing Price: $70.33

- Market Outlook: Confirmed uptrend

- RS Rating: 95

- RS Change: -1

- Remarks: “Due to a strong down day, the position was stopped out.”

Results

- What went well? “I had raised the stop-loss during the trade, which minimized my losses. I bought the stock close to the EMA 21 line during an uptrend that began with a strong up day on February 7th.”

- Cause of Error / Improve: “I should have bought the stock sooner. A good time for buying was in February 2024 and also earlier. The best time for an initial buy would have been on 1 Nov 2023 when the stock broke out of a solid flat base. I should have sold the stock 1 day sooner when the price broke below the EMA 21 line.”

- Lessons Learned: “I need to hunt more for stocks that are near their pivot price and try to break out of a base. It would be a good idea to place price alerts on these stocks. At times, I have still made the same mistakes I thought I had trained out of myself—this time it was selling a day too late.”

- Position ROI, %: -1.91

- Position ROI (Portfolio), %: -0.12

- Position Open Time (Trading Days): 14

- Position Open Time (Days): 22

Definitions and explanations

Green Line 21-day exponential moving average line (see EMA 21 below)

Red Line 50-day simple moving average line (see SMA 50 below)

Black LIne 200-day simple moving average line (see SMA 200 below)

EMA 21 Calculates the 21-period exponential moving average, highlighting short-term trends.

SMA 50 Averages the price over 50 periods, showing medium-term trends without overemphasizing recent data.

SMA 200 Averages the price over 200 periods, revealing long-term trends by treating all data equally.

Industry Rank Investor’s Business Daily’s system that ranks industries 1 to 197 based on performance. It guides us in CAN SLIM TRADING towards leading sectors.

U/D Ratio Measures stocks closing up versus down. A ratio above 1.0 indicates bullish sentiment, important in CAN SLIM TRADING.

RS Rating Ranks a stock’s performance on a 1 to 99 scale. I look for at least 85, showing strong momentum and growth potential.

RS Line Compares stock price to the market, plotted as a ratio. We seek an uptrend, indicating outperformance and strong momentum.

Volatility Measures how much a security’s price fluctuates over time. High volatility means large price changes, indicating risk and potential reward.

Institutional Ownership Trend indicates whether the stock is under accumulation or distribution by the institutions.

EPS (Earnings Per Share): A financial metric calculated by dividing a company’s net profit by the number of its outstanding shares. It indicates the amount of profit attributed to each share of stock, serving as a key indicator of a company’s profitability.

Conclusion

Understanding each trading decision’s nuances is crucial. By examining and learning from our mistakes, we not only improve our strategies but also open opportunities for much greater gains. Instead of a 1.91% loss in the trade, I could have gained 12% since February 2024 or 60% since November 2023! What mistakes have you made that you aren’t even aware of?