Do you want to be more knowledgeable about your trading? This article reveals 3 secrets to improve your trading. Follow these guidelines regularly and your results will improve.

taking a position

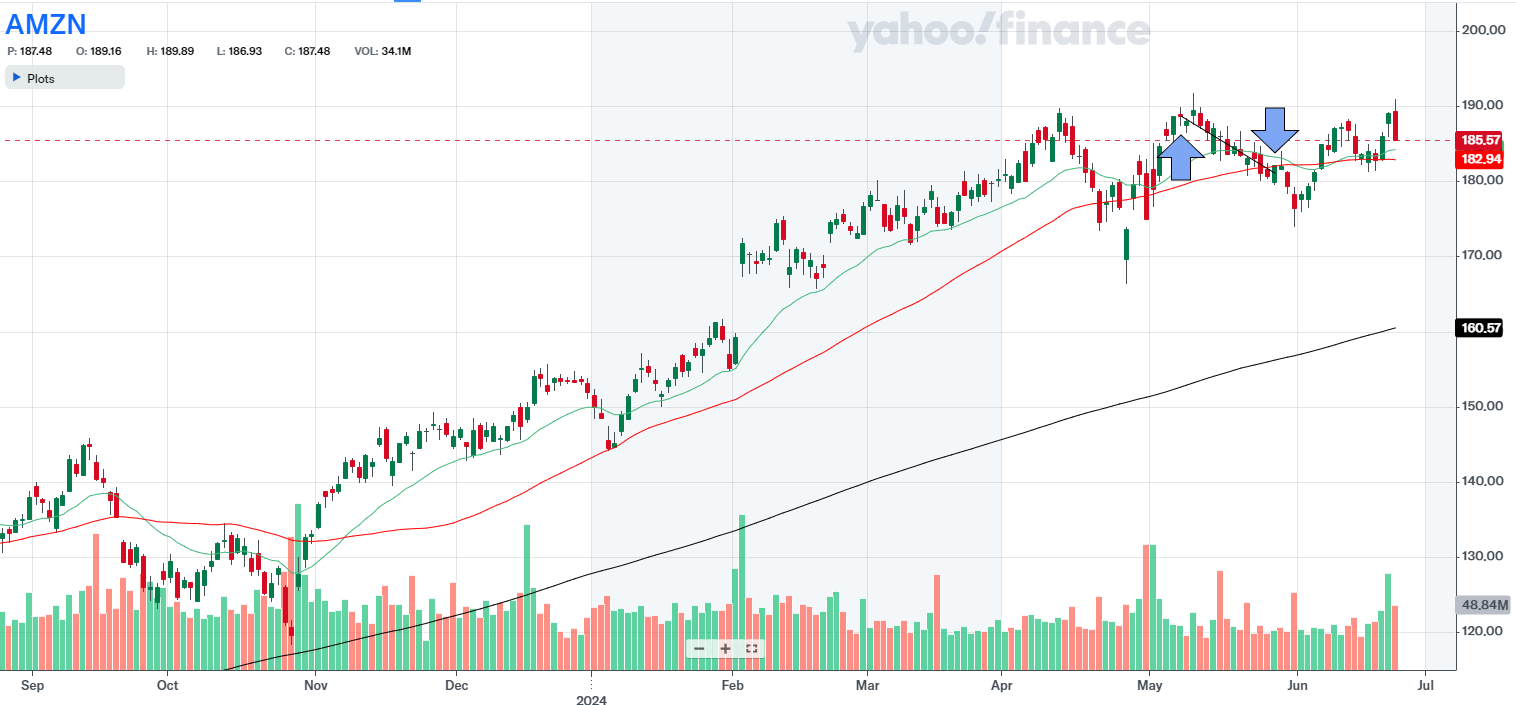

On May 7, 2024, I decided to dip my toes into Amazon stock, AMZN. The price at the time was $189.00, and I set my stop loss at $179.97.

My goal was to manage my risk carefully, limiting my position risk to 4.75% and my position risk to net liquidating value (NL) to 0.41%. I was aiming for a profit target of $226.80, a potential profit of 19.89%, with a risk-to-reward ratio of 0.24. The market outlook was promising, in a confirmed uptrend.

With a Relative Strength (RS) Rating of 90 and an upward RS line trend, AMZN seemed like a good bet despite its industry rank being a mediocre 91 out of 197. However, institutional ownership trends were positive, and the volume up/down ratio was a solid 1.3. I allocated 8.60% of my portfolio to this position.

So, why did I open this trade at that point? The price had risen after earnings, which seemed like a good sign.

Was it an ideal buy? No, it wasn’t. The price wasn’t coming out of a base, and that’s a crucial factor. At the time of buying, the industry rank was low, but given it’s Amazon, this reduced some risk.

Closing position

Fast forward to May 28, 2024, and things weren’t looking so rosy. The closing price had slid to $180.11. The market outlook was still a confirmed uptrend, but the RS Rating had fallen to 87, down by 3 points.

The stock had been underperforming the market, which was evident from the drop in the RS rating. Since the price started to slide, I was stopped out of my position.

Results

Here’s where the lessons really kicked in:

- What went well?: The decision to buy after a positive reaction to earnings was a good one.

- Cause of Error / IMPROVE: I was too late closing the position. The price started to slide below the 21-day EMA on May 16. I should have closed the position by May 21 when it was already below the 50-day moving average. I shouldn’t rely solely on my stop-losses. This is an addition to my trading strategy. Especially given that the stock was not from a leading industry. The stock price was extended when I bought; it was more than 3% above EMA 21.

- Lessons Learned: This happened because I haven’t been monitoring the stocks in my portfolio enough. I need to keep a closer eye on them.

- Position ROI, %: -5.73

- Position ROI (portfolio), %: -0.49

- Position Open Time (trading days): 15

- Position Open Time (days): 21

So, what went wrong, and how can I improve next time? The decision to buy after a positive earnings reaction was smart.

But, I was way too late closing the position. The price had already started to slide below the 21-day EMA on May 16, and I should have acted sooner. By May 21, it was below the 50-day moving average, a clear sign to exit. I learned that relying solely on stop-losses isn’t enough.

I also realized the stock wasn’t from a leading industry, and its price was too extended when I bought it. Monitoring my portfolio more closely is crucial. These are the lessons that will shape my future trades.

in a nutshell

secret#1: Sell rather too early than too late

According to the book “How To Make Money In Stocks,” the aim should be to sell faster than anyone else. However, I didn’t achieve that this time. Instead, I allowed the position to remain ‘underwater’ for a week. This is unacceptable because it ties up our capital unnecessarily. Rather than waiting for conditions to improve, our approach should focus on interpreting the market and acting decisively.

But why did I make this mistake? Was it fear of selling or excessive optimism? Surprisingly, it was neither; I simply wasn’t aware this was happening. This oversight leads us to the next point…

secret #2: Monitor your positions daily

This is particularly crucial when trading stocks outside of leading industries or during volatile periods. Establishing a daily routine for monitoring your positions—when, where, and how you review them—is essential.

When checking your positions daily, what criteria should you consider? A key question to ask yourself regularly is:

AM I STILL BULLISH ON THIS POSITION?

This question directs your focus to what truly matters. If a stock in your portfolio has declined for several consecutive days, it may no longer be the best candidate.

If such behavior persists, I often liken the stock to a weed in a garden that must be removed for the portfolio to thrive.

secret #3: don’t rely solely on your stop-losses

Active trading and investing are as much about developing your character as they are about strategy. While stop-loss orders are effective tools, relying solely on them can create a disconnect between you and your portfolio.

This distance can lead to more errors, resulting in avoidable losses, as was the case for me this time. From my experience, setting a stop-loss as a safety measure (and never adjusting it downward during a trade) is crucial. However, if a position starts to decline, it’s often best to exit the stock promptly.

These principles underscore the importance of proactive monitoring and disciplined decision-making in achieving successful trading outcomes.

details at a glance

Explanations for the Drawing: The upward purple arrow shows where I bought the stock. The downward purple arrow shows where I sold it.

Green Line 21-day exponential moving average line (see EMA 21 below)

Red Line 50-day simple moving average line (see SMA 50 below)

Black Line 200-day simple moving average line (see SMA 200 below)

Opening the position

- Underlying: AMZN

- Date: 7 May 2024

- Underlying Price: 189.00

- Stop Loss: 179.97

- Position Risk, %: 4.75

- Position Risk to NL, %: 0.41

- Profit Target: 226.80

- Potential Profit (position), %: 19.89

- Risk to Reward Ratio: 0.24

- Market Outlook: Confirmed uptrend

- RS Rating: 90

- RS Line Trend (U/N/D): U

- Industry Rank (X / 197): 91

- Volume U/D Ratio: 1.3

- Institutional Ownership Trend (U/N/D): U

- Position Size, %: 8.60

- Why did I open this trade at that point? (eg CAN SLIM, EMA 21): Price rose after earnings, which is a good sign.

- Was it an ideal buy?: No. Price wasn’t coming out of a base.

- Remarks: At the time of buying the stock, the industry rank was 91/197, which is low. However, since it’s AMZN, this reduces some risk.

Closing the position

- Date: 28 May 2024

- Price (close): 180.11

- Market Outlook: Confirmed uptrend

- RS Rating: 87

- RS Change: -3

key Results

- Position ROI, %: -5.73

- Position ROI (portfolio), %: -0.49

- Position Open Time (trading days): 15

- Position Open Time (days): 21

conclusion

There you have it! 3 important secrets to implement. As my experience shows, markets are very complex and there are a ton of nuances to notice and remember. This leads us to the situation that we tend to repeat some of our mistakes.

It’s not that we should beat ourselves up for that but we need to be persistent and work on removing every mistake from our actions. This is probably the only way to succeed.

P.s.

If you have any thoughts or questions about trading or investing, fill out the form here and I’ll get back to you.