introduction

Welcome to the latest edition of my Weekly Portfolio Update for the week of February 3rd, 2024. In this report, I will present a comprehensive overview of my portfolio, recent stock analyses, investment rationales, and insights into potential adjustments. We will delve into the performance of individual stocks, assess their key metrics, and examine the factors that drive my investment decisions.

market overview

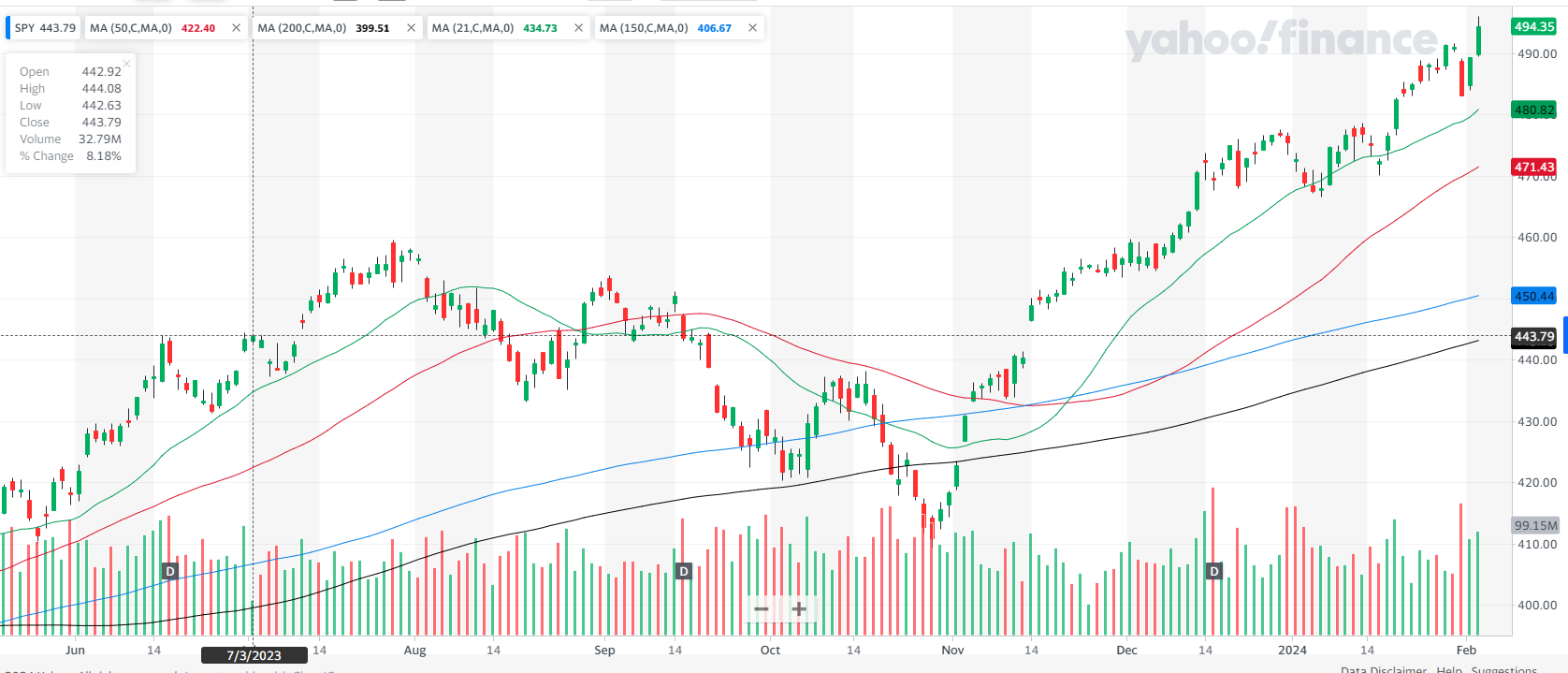

sPY IS VERY POSITIVE:

To me, it looks even a little bit extended which could mean a small reversal could come any time soon. However, the price trends up with a relatively high value which indicates that the overall trend seems to be strong. There have been a few more volatile days lately (see the higher bars).

qqq is also positive:

The ETF that indicates the NASDAQ index is a little bit calmer than the SPY but as usual, they both tend to go hand in hand. In this graph, there is also a noticeable strength in the up-trending price.

All this means that the overall environment for investing and trading is positive and there are a lot of opportunities to place your bets. So, let’s delve into my latest portfolio update.

PORTFOLIO OVERVIEW

Compared to last week’s portfolio position, there are quite a lot of changes. That being said, I am always trying to hold my position for as long as reasonably possible.

The word ‘reasonably’ is very important here. I don’t want to hold any position that shows weakness. Also, I don’t want to hold the position through the earnings release, unless I have at least a 5% profit cushion built in.

Here are the positions:

CRWD

- Portfolio Percentage: 13.81%

- RS Rating: 98

- RS line: Uptrend

- Stop Loss Area: 285

- Earnings Growth: 105%

- Sales Growth: 35%

- Institutional ownership: Uptrend

- Up/Down volume ratio: 2.5. This one has increased by 0.2 percentage points compared to last week.

- Remarks: Stock seems to be under strong accumulation. The position in my portfolio is bigger than 10% which means that my portfolio is especially sensitive to the performance of stock price movements.

SPXC

- Portfolio Percentage: 9.63%

- RS Rating: 91

- RS line: Uptrend

- Stop Loss Area: 97

- Earnings Growth: 31%

- Sales Growth: 21%

- Institutional ownership: Downtrend

- Up/Down volume ratio: 1.3

- Remarks: Since institutional ownership has been down, there might be a need for selling when the price starts declining. So far, the price has been holding up. However, the earnings release date is approaching and the profit cushion has not exceeded 5%.

cnm

- Portfolio Percentage: 5.77%

- RS Rating: 95

- RS line: Uptrend

- Stop Loss Area: 38

- Earnings Growth: 0%

- Sales Growth: 0%

- Institutional ownership: Uptrend

- Up/Down volume ratio: 1.9

- Remarks: As you can see, it is not a CAN SLIM stock but it is in a strong uptrend and the trend has power behind it. Also, institutions seem to be accumulating it. Since it is purely a speculation, I am probably not going to increase the position size.

estc

- Portfolio Percentage: 5.67%

- RS Rating: 98

- RS line:Uptrend

- Stop Loss Area: 115

- Earnings Growth: 999%

- Sales Growth: 17%

- Institutional ownership: Uptrend

- Up/Down volume ratio: 1.8

- Remarks: The stock is almost CAN SLIM but I have bought it at a relatively high place. The last time the price was below SMA 200 was long ago. This makes it a speculation.

pgti

- Portfolio Percentage: 5.61%

- RS Rating: 96

- RS line: Uptrend

- Stop Loss Area: 39

- Earnings Growth: 20%

- Sales Growth: 4%

- Institutional ownership: Downtrend

- Up/Down volume ratio: 1.8

- Remarks: This one is also not CAN SLIM. The indicators that have caught my eye have been strong uptrends and outperformance.

phm

- Portfolio Percentage: 4.82%

- RS Rating: 94

- RS line: Uptrend

- Stop Loss Area: 100

- Earnings Growth: -10%

- Sales Growth: -15%

- Institutional ownership: Uptrend

- Up/Down volume ratio: 0.9

- Remarks: This one is even more speculative since its up/down ratio is less than 1. This means that the stock is under slight distribution. Other than that, the company is in the leading industry and the stock is outperforming 94% of the market.

shop

- Portfolio Percentage: 3.77%

- RS Rating: 94

- RS line: Slight uptrend

- Stop Loss Area: 75

- Earnings Growth: 999%

- Sales Growth: 25%

- Institutional ownership: Slight downtrend

- Up/Down volume ratio: 1.5

- Remarks: SHOP is a CAN SLIM stock right now. I would like to increase its position in my portfolio but the earnings date is quite close, so I am not going to do that right now.

As planned, I closed all the positions for ETN, AMZN, GOOGL, and FROG. In hindsight, closing ETN and AMZN was not a good idea, since both of them have greatly appreciated. But you will never know how the market reacts to the earnings. Selling GOOGL was a good idea.

INVESTMENT RATIONALE

I meticulously analyze and select stocks based on specific criteria:

- Selection Criteria: I choose stocks by evaluating factors such as growth potential, financial stability, industry outlook, and historical performance.

- RS Rating: I prioritize stocks with high RS Ratings, indicating strong price momentum.

- Financial Performance: I assess factors like earnings growth, sales growth, and profitability to gauge a company’s financial health.

- Industry Analysis: My decisions are influenced by industry trends, competition, and growth prospects.

- Long-term Outlook: I emphasize long-term investments, focusing on sustained growth potential.

- Risk Assessment: I acknowledge and address potential risks associated with each stock.

- Diversification: To spread risk and enhance portfolio stability, I don’t usually buy a bigger position than 10% of the portfolio’s value (Net Liq).

- Market Trends: My decision-making considers current market trends and economic conditions.

In summary, my stock selection process combines meticulous analysis and a long-term perspective to construct a resilient and potentially rewarding portfolio.

TECHNICAL AND FUNDAMENTAL ANALYSIS

My investment strategy combines technical and fundamental analyses for a comprehensive approach. These methods shape my portfolio management, allowing me to make informed decisions.

- Technical Precision: Technical analysis is central. I study charts and data to spot market trends and optimize entry and exit points, leveraging historical price movements for guidance.

- Fundamental Foundation: Fundamental analysis serves as a solid foundation, evaluating financial health, including earnings growth and profitability, ensuring my choice of robust companies.

- Balanced Decision-Making: Balancing technical precision and fundamental stability is key. It helps me endure market fluctuations while pursuing long-term growth.

- Market Insight: Integrating technical and fundamental analyses provides a holistic market understanding. This equips me to adapt to changing conditions while aligning with my investment goals.

In summary, combining technical and fundamental analyses empowers resilient portfolio construction. It ensures adaptability while pursuing long-term growth and investment objectives.

INSTITUTIONAL OWNERSHIP AND INDUSTRY ANALYSIS

I place significant importance on institutional ownership and industry prominence when evaluating stocks because they play pivotal roles for two compelling reasons:

- Institutions’ actions often dictate the trajectory of both individual stocks and the broader market. When they select a specific industry for investment, that industry typically outperforms others.

- The same principle applies to individual stocks, where institutional support can significantly influence their performance.

These dual factors underscore why I prioritize industry analysis and institutional ownership in my stock evaluations.

RISK FACTORS

The biggest risk is that the overall market can take a sudden dive at any time. We all have to keep that in mind. It could happen at any moment, which is why we need to watch the overall market and our stocks closely.

Right now, things seem to be looking up, but we can’t predict how long that will last. That’s why we have to be ready to adapt.

I’ve carefully picked the stocks and their percentages in my portfolio, but I always remember that things can change in an instant. This goes for both the whole market and individual stocks.

When that happens, it’s time to take protective measures.

CONCLUSION

In conclusion, my strategy revolves around choosing outperforming stocks in uptrends, backed by strong institutional ownership and favorable industry positioning. While I aim for robust returns, I am also mindful of the inherent risks, especially in a changing market environment. It’s crucial to stay vigilant and adapt to market conditions.

Stay Tuned:

Thank you for joining me on this journey of portfolio management and stock analysis. Stay tuned for the next update!